Kodak 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

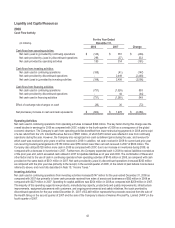

Financing Activities

Net cash used in financing activities decreased $549 million for the year ended December 31, 2008 as compared with 2007 due to

lower repayments of borrowings, mainly due to the repayment of the Company’s Secured Term Debt in the second quarter of 2007

that was required as a result of the sale of the Health Group. These reductions in cash usage were partially offset by repurchases of

the Company’s common stock of $301 million in 2008.

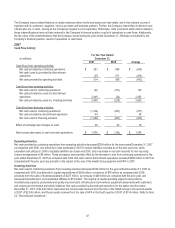

On June 24, 2008, the Company announced that its Board of Directors authorized a share repurchase program allowing the

Company, at management’s discretion, to purchase up to $1.0 billion of its common stock. The program will expire at the earlier of

December 31, 2009 or when the Company has used all authorized funds for the repurchase of shares. Through December 31, 2008,

the Company repurchased approximately 20 million shares at an average price of $15.01 per share, for a total cost of $301 million

under this program. While the share repurchase authorization remains in effect through the end of 2009, the Company is not

currently repurchasing any of its shares.

It is the Company’s practice to make semi-annual dividend payments which, when declared by its Board of Directors, will be paid on

the Company’s 10th business day each July and December to shareholders of record on the close of the first business day of the

preceding month. On May 14, and October 14, 2008, the Board of Directors declared semi-annual cash dividends of $.25 per share

payable to shareholders of record at the close of business on June 1, and November 3, 2008, respectively. These dividends were

paid on July 16, and December 12, 2008. Total dividends paid for the year ended December 31, 2008 were $139 million.

The Company’s long-term debt, net of current portion, of $1,252 million as of December 31, 2008, includes $575 million aggregate

principal amount of Convertible Senior Notes due 2033 (the “Convertible Securities”). The security holders have the right to require

the Company to purchase their Convertible Securities for cash at a price equal to 100% of the principal amount of the Convertible

Securities, plus any accrued and unpaid interest on October 15, 2010, October 15, 2013, October 15, 2018, October 15, 2023 and

October 15, 2028, or upon a fundamental change as described in the offering memorandum filed under Rule 144A in conjunction

with the private placement of the Convertible Securities. Because of current market conditions, the Company believes it is probable

that all, or nearly all, of the Convertible Securities will be redeemed by the security holders on October 15, 2010.

Sources of Liquidity

The Company believes that its current cash balance, combined with cash flows from operating activities and proceeds from sales of

assets, will be sufficient to meet its anticipated needs, including working capital, capital investments, scheduled debt repayments,

restructuring and dividend payments and employee benefit plan payments or contributions required. If the global economic

weakness trends continue for a greater period of time than anticipated or worsen, it could impact the Company's profitability and

related cash generation capability. Refer to Item 1A. of Part I, "Risk Factors." In addition to its existing cash balance, the Company

has maintained financing arrangements, as described in more detail below under "Credit Quality," to facilitate unplanned timing

differences between required expenditures and cash generated from operations or for unforeseen shortfalls in cash flows from

operating activities. The Company has not found it necessary to borrow against these financing arrangements over the past three

years.

Refer to Note 8, "Short-Term Borrowings and Long-Term Debt" in the Notes to Financial Statements for further discussion of sources

of liquidity, presentation of long-term debt, related maturities and interest rates as of December 31, 2008 and 2007.

Credit Quality

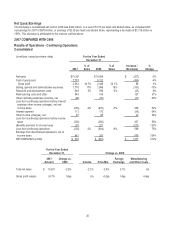

Moody's and Standard & Poor’s (“S&P”) ratings for the Company, including their outlooks, as of the filing date of this Form 10-K are

as follows:

Senior Most

Corporate Secured Unsecured Recent

Rating Rating Rating Outlook Update

Moody's B3 Ba3 Caa1 Negative February 10, 2009

S&P B BB- B- Negative January 30, 2009

On December 11, 2008, S&P lowered the Company’s Corporate, Secured, and Senior Unsecured credit ratings from B+ to B, BB to

BB-, and B to B-, respectively. The ratings remain on CreditWatch with negative implications, where they were placed on November

3, 2008 following the Company’s revision of its earnings guidance. S&P reconfirmed its ratings and CreditWatch with negative

implications on January 30, 2009. S&P’s practice is to complete their review and resolve ratings under CreditWatch in approximately

90 days from when ratings are placed on CreditWatch. The Company expects S&P to complete their CreditWatch review within the

first quarter of 2009.