Kodak 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

(5) The exercise price of the options is the mean between the high and low price of our common stock on the date of grant. The

options become exercisable on the first anniversary of the date of grant and expire seven years after grant. Directors who stop

serving on the Board prior to vesting forfeit their unvested options, unless their cessation of service is due to retirement,

approved reason or death. In the case of retirement and cessation for approved reason, the options continue to vest per their

terms and remain exercisable for the remainder of the option’s full term. In the case of death, the options fully vest upon death

and remain exercisable by the directors’ estate for the remainder of the option’s full term.

(6) Currently, our Presiding Director also serves as the Chair of the Compensation Committee and therefore receives an additional

retainer as Chair of that committee.

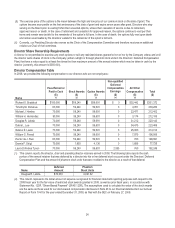

Director Share Ownership Requirements

A director is not permitted to exercise any stock options or sell any restricted shares granted to him or her by the Company unless and until

the director owns shares of stock in the Company (either outright or through phantom stock units in the Directors’ Deferred Compensation

Plan) that have a value equal to at least five times the then maximum amount of the annual retainer which may be taken in cash by the

director (currently, this amount is $350,000).

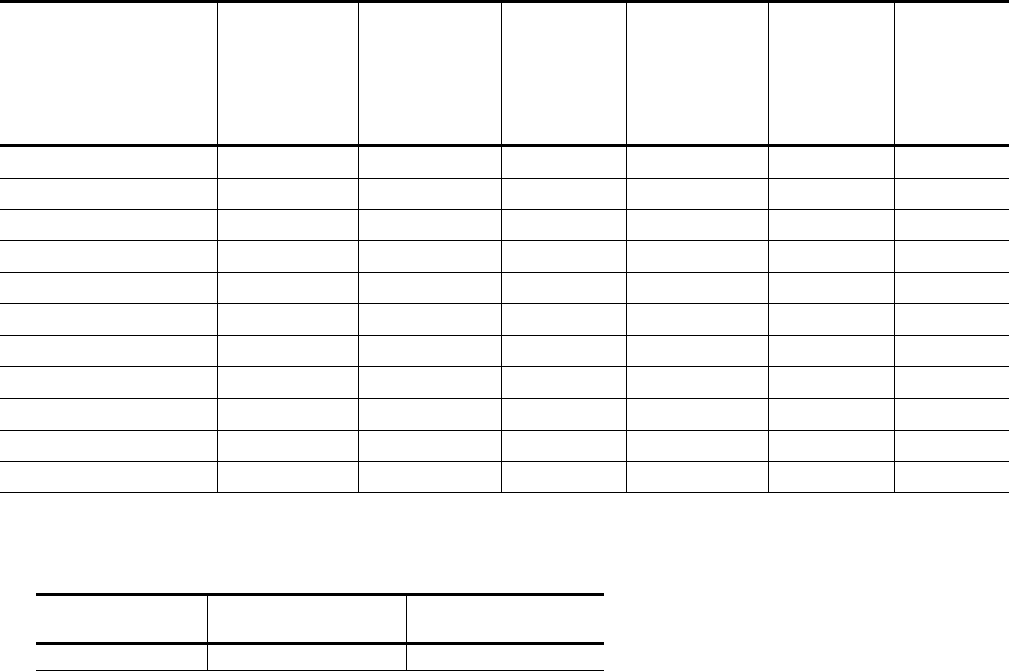

Director Compensation Table

In 2008, we provided the following compensation to our directors who are not employees:

Name

Fees Earned or

Paid In Cash

($)

(1)

Stock Awards

($)

(2)

Option Awards

($)

(3)

Non-qualified

Deferred

Compensation

Earnings

($)

(4)

All Other

Compensation

($)

(5)

Total

($)

Richard S. Braddock $180,000 $59,240 $59,691 $ 0 $32,442 $331,372

Timothy M. Donahue 80,000 59,240 59,691

0

4,351 203,282

Michael J. Hawley 70,000 59,240 59,691

0

23,471 212,402

William H. Hernandez 90,000 59,240 59,691

0

3,174 212,105

Douglas R. Lebda 70,000 59,240 59,691

0

31,212 220,143

Debra L. Lee 70,000 59,240 59,691

0

34,475 223,406

Delano E. Lewis 70,000 59,240 59,691

0

25,083 214,014

William G. Parrett 70,000 59,240 59,691

0

7,975 196,906

Hector de J. Ruiz 80,000 59,240 59,691

0

760 199,691

Dennis F. Strigl 70,000 1,903 4,136

0

1,686 77,725

Laura D’Andrea Tyson 70,000 59,240 59,691

2,555

760 192,246

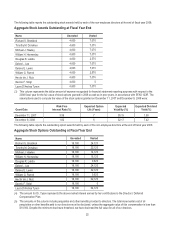

(1) This column reports the director, chair and presiding director retainers earned in 2008. The following table reports the cash

portion of the annual retainer that was deferred by a director into his or her deferred stock account under the Directors’ Deferred

Compensation Plan and the amount of phantom stock units that were credited to the director as a result of that deferral.

Name

Deferred

Amount

Phantom

Stock Units

Douglas R. Lebda $70,000 4,091.62

(2) This column represents the dollar amount of expense recognized for financial statement reporting purposes with respect to the

2008 fiscal year for the fair value of restricted stock awards granted in 2008, as well as prior fiscal years, in accordance with

Statement No. 123R, “Share-Based Payment” (SFAS 123R). The assumptions used to calculate the value of the stock awards

are the same as those used for our stock-based compensation disclosure in Note 20 to our financial statements in our Annual

Report on Form 10-K for the year ended December 31, 2008, as filed with the SEC on February 27, 2009.