Kodak 2008 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

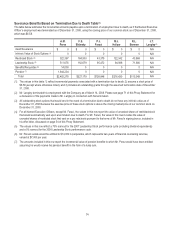

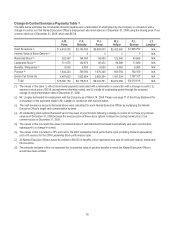

Change-in-Control Severance Payments Table (1)

The table below estimates the incremental amounts payable upon a termination of employment by the Company in connection with a

change-in-control, as if the Named Executive Officer’s employment was terminated as of December 31, 2008 using the closing price of our

common stock as of December 31, 2008, which was $6.58.

A.M.

Perez

F.S.

Sklarsky

P.J.

Faraci

M.J.

Hellyar

R.L.

Berman

J.T.

Langley(2)

Cash Severance (3) $ 8,415,000 $3,150,000

$3,885,000

$2,425,500 $1,905,750 N/A

Intrinsic Value of Stock Options (4) 00

0

00N/A

Restricted Stock (5) 322,367 164,500

56,535

122,342 43,869 N/A

Leadership Stock (6) 511,676 162,679

95,472

94,088 71,680 N/A

Benefits / Perquisites (7) 9,050 9,050

9,050

9,050 9,050 N/A

Pension (8) 1,644,234 769,590

1,976,349

809,754 792,159 N/A

Excise Tax Gross-Up 4,487,822 1,922,694

2,982,354

1,451,334 1,197,107 N/A

Total $15,390,150 $6,178,513

$9,004,761

$4,912,068 $4,019,616 N/A

(1) The values in this table: 1) reflect incremental payments associated with a termination in connection with a change-in-control; 2)

assume a stock price of $6.58 (except where otherwise noted); and 3) include all outstanding grants through the assumed

change-in-control/termination date of December 31, 2008.

(2) Mr. Langley terminated his employment with the Company as of March 14, 2008. Please see page 71 of this Proxy Statement for

a discussion of the payments made to Mr. Langley in connection with his termination.

(3) The cash severance amounts disclosed above were calculated for each Named Executive Officer by multiplying the Named

Executive Officer's target cash compensation by three.

(4) All outstanding stock options that would vest in the event of a termination following a change-in-control do not have any intrinsic

value as of December 31, 2008 because the exercise price of these stock options is above the closing market price of our

common stock on December 31, 2008.

(5) The values in this row report the value of unvested shares of restricted stock that would automatically vest upon a termination

subsequent to a change-in-control.

(6) The values in this row reflect a 73% earnout for the 2007 Leadership Stock performance cycle (including dividend equivalents)

and a 0% earnout for the 2008 Leadership Stock performance cycle.

(7) All Named Executive Officers would be entitled to $9,050 in benefits, which represents one year of continued medical, dental and

life insurance.

(8) The amounts included in this row represent the incremental value of pension benefits to which the Named Executive Officers

would have been entitled.