Kodak 2008 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

DIRECTOR COMPENSATION

Introduction

Our directors are compensated through a combination of cash retainers and equity-based incentives. Consistent with the Board’s Director

Compensation Principles, a substantial portion of director compensation is linked to our stock performance. In addition, directors can elect

to receive their entire Board remuneration in equity-based compensation. Our directors are required to keep all of the shares, net of any

shares used to pay the exercise price when exercising an option, they receive as compensation until they own shares equal in market

value to at least five times their annual retainer that is paid in cash.

Kodak does not pay management directors for Board service in addition to their regular employee compensation.

Director Compensation Principles

The Board has adopted the following director compensation principles, which are aligned with the Company’s executive compensation

principles:

• Pay should represent a moderately important element of Kodak’s director value proposition.

• Pay levels should generally target near the market median, and pay mix should be consistent with market considerations.

• Pay levels should be differentiated based on the time demands on some members’ roles, and the Board will ensure regular

rotation of certain of these roles.

• The program design should ensure that rewards are tied to the successful performance of Kodak stock, and the mix of pay

should allow flexibility and Board diversity.

• To the extent practicable, Kodak’s Director Compensation Principles should parallel the principles of the Company’s executive

compensation program.

Review

The Governance Committee, which consists solely of independent directors, has the primary responsibility for reviewing and considering

any changes to the Board’s compensation program. The Board reviews the Governance Committee’s recommendation and determines the

amount of director compensation.

The Governance Committee last completed a review of the Board’s compensation program in 2007. In connection with this review, the

Governance Committee retained Peal Meyer & Partners, independent compensation consultant, to competitively assess our director

compensation relative to market trends and comparable peer companies.

Director Compensation Program

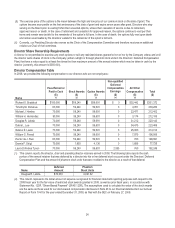

The annual cash and equity components of the Company’s director compensation program are now as follows:

Cash Equity(1)

Board Retainer

(2)

Chair/Presiding

Director Retainer

(3)

Restricted Stock

(4)

Stock Options

(5) Total

Director $70,000 — $70,000 $70,000 $210,000

Presiding Director (6) 70,000 $100,000 70,000 70,000 310,000

Audit Committee Chair 70,000 20,000 70,000 70,000 230,000

Compensation Committee Chair 70,000 10,000 70,000 70,000 220,000

Finance Committee Chair 70,000 10,000 70,000 70,000 220,000

Governance Committee Chair 70,000 10,000 70,000 70,000 220,000

(1) The methodology used to convert the dollar-denominated value of equity awards to the actual quantities of restricted stock and

stock options that are granted is discussed on page 46 of this Proxy Statement.

(2) Directors can elect to have their cash Board retainer paid in stock or deferred into the Directors’ Deferred Compensation Plan.

(3) The Committee Chairs and the Presiding Director may elect to have their retainers paid in stock or deferred into the Directors’

Deferred Compensation Plan.

(4) The restricted shares vest on the first anniversary of the date of grant. Directors who stop serving on the Board prior to vesting

forfeit their restricted shares, unless their cessation of service is due to retirement, approved reason or death, in which case the

restrictions on the shares lapse on the date of the director’s cessation of service. Directors may elect to defer their restricted

shares into the Directors’ Deferred Compensation Plan.