Kodak 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

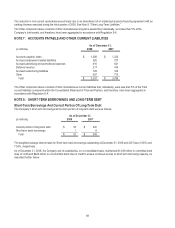

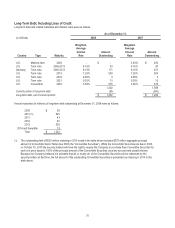

The Company may redeem some or all of the Convertible Securities at any time on or after October 15, 2010 at a purchase price

equal to 100% of the principal amount of the Convertible Securities plus any accrued and unpaid interest. Upon a call for redemption

by the Company, a conversion trigger is met whereby the holder of each $1,000 Convertible Senior Note may convert such note to

shares of the Company's common stock.

The holders have the right to require the Company to purchase their Convertible Securities for cash at a purchase price equal to

100% of the principal amount of the Convertible Securities plus any accrued and unpaid interest on October 15, 2010, October 15,

2013, October 15, 2018, October 15, 2023 and October 15, 2028, or upon a fundamental change as described in the offering

memorandum filed under Rule 144A in conjunction with the private placement of the Convertible Securities. As noted above, the

Company believes it is probable that all, or nearly all, of the Convertible Securities will be redeemed by the security holders on

October 15, 2010. As a result, the full amount of the outstanding Convertible Securities is presented as maturing in 2010 in the debt

maturity table above. As of December 31, 2008, the Company has sufficient treasury stock to cover potential future conversions of

these Convertible Securities into 18,536,447 shares of common stock.

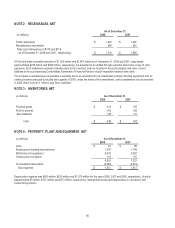

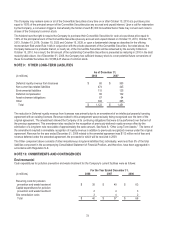

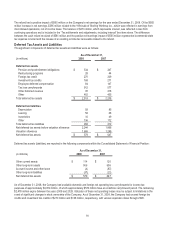

NOTE 9: OTHER LONG-TERM LIABILITIES

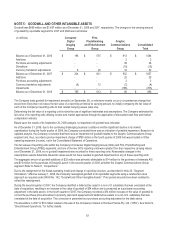

As of December 31,

(in millions) 2008 2007

Deferred royalty revenue from licensees $ 65 $ 350

Non-current tax-related liabilities 474 445

Environmental liabilities 115 125

Deferred compensation 68 102

Asset retirement obligations 67 64

Other 333 365

Total $ 1,122 $ 1,451

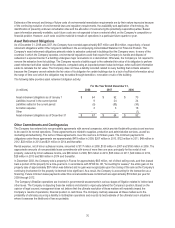

The reduction in Deferred royalty revenue from licensees was primarily due to an amendment of an intellectual property licensing

agreement with an existing licensee. Revenue related to this arrangement was previously being recognized over the term of the

original agreement. The amendment relieved the Company of its continuing obligations that were to be performed over the term of

the previous agreement. This amendment also resulted in the recognition of previously deferred royalty revenue offset by the

elimination of a long-term note receivable of approximately the same amount. See Note 6, “Other Long-Term Assets.” The terms of

the amendment resulted in immediate recognition of royalty revenue in addition to previously recognized revenue under the original

agreement. Revenue for the year ended December 31, 2008 related to the amended agreement was $112 million net of fees and

revenue deferred under the amended agreement, the proceeds for which will be received in 2009.

The Other component above consists of other miscellaneous long-term liabilities that, individually, were less than 5% of the total

liabilities component in the accompanying Consolidated Statement of Financial Position, and therefore, have been aggregated in

accordance with Regulation S-X.

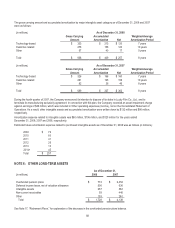

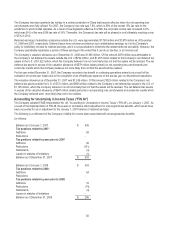

NOTE 10: COMMITMENTS AND CONTINGENCIES

Environmental

Cash expenditures for pollution prevention and waste treatment for the Company's current facilities were as follows:

For the Year Ended December 31,

(in millions) 2008 2007

2006

Recurring costs for pollution

prevention and waste treatment $ 35 $ 49

$63

Capital expenditures for pollution

prevention and waste treatment 2 4

3

Site remediation costs 3 4

2

Total $ 40 $ 57

$68