Kodak 2008 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

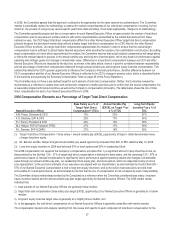

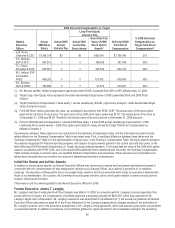

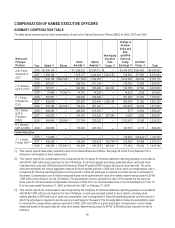

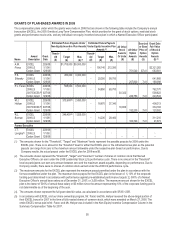

2008 Delivered Compensation vs. Target

Long-Term Equity

Incentive Plan

Named

Executive

Officer

Actual

2008 Base

Salary

Actual 2008

Annual

Variable Pay

Actual 2008

Leadership

Stock Award

Grant Date Fair

Value of 2008

Stock Option

Award(4)

Delivered 2008

Total Direct

Compensation

% 2008 Delivered

Compensation vs.

Target Total Direct

Compensation(5)

A.M. Perez,

Chairman & CEO $1,096,168 $0 $0 $683,901

$1,780,069

21%

F.S. Sklarsky,

EVP&CFO 597,911 0 0 189,098

787,009

30%

P.J. Faraci,

President & COO 697,561 0 0 224,543

922,104

29%

M.J. Hellyar, EVP

& President,

FPEG 488,293 0 0 120,302

608,595

33%

R.L. Berman,

SVP & CHRO 383,658 0 0 91,673

475,331

34%

(1) Mr. Berman and Ms. Hellyar's target award opportunity under EXCEL increased from 62% to 65% effective May 12, 2008.

(2) Target Long-Term Equity Value represents the dollar-denominated target value of 2008 Leadership Stock and 2008 Stock

Options.

(3) Target Total Direct Compensation = base salary + annual variable pay (EXCEL) opportunity at target + dollar-denominated target

value of long-term equity.

(4) Full 2008 Stock Option grant date fair value, as calculated in accordance with SFAS 123R. The actual value of the stock option

grant will be a function of stock price. The grant price of the 2008 stock option award was $7.41. The closing price of the stock as

of December 31, 2008 was $6.58. Therefore, the intrinsic value of the stock options on December 31, 2008 was zero.

(5) Percent 2008 Delivered Compensation = (actual 2008 base salary + actual 2008 annual variable pay award earned + 2008

Leadership Stock award earned + 2008 stock option grant date fair value) divided by Target Total Direct Compensation as

defined in footnote 3.

As previously indicated, these tables are not a substitute for the Summary Compensation table, and the information provided in these

tables differs from the Summary Compensation Table in two major ways. First, a significant difference between these tables and the

Summary Compensation Table is in the representation of equity value. In the Summary Compensation Table, the equity awards represent

the expense recognized for financial reporting purposes, with respect to equity awards granted in the current year and prior years. In the

table reflecting 2008 Delivered Compensation vs. Target, the equity awards represent: 1) the grant date fair value of the 2008 stock option

award in accordance with SFAS 123R, and 2) the actual 2008 Leadership Stock awards earned. Secondly, the Summary Compensation

Table includes changes in pension value, non-qualified deferred compensation and perquisites. These amounts are not included in the

tables above because they are not taken into account in determining total direct compensation.

Initial Hire Grants and Ad Hoc Awards

In addition to annual equity awards, our Named Executive Officers may receive stock options and time-based restricted stock grants in

connection with the commencement of their employment, election as a Company Officer, as a result of a promotion or for retention

purposes. The objectives of these grants are to encourage hiring, retention and stock ownership and to align an executive’s interests with

those of our shareholders. On occasion, the Committee may also grant one-time, ad hoc stock option awards to reward an executive for

superior individual performance.

There were no ad hoc awards granted to any Named Executive Officers in 2008.

Former Executive: James T. Langley

Mr. Langley’s last day of employment with the Company was March 14, 2008. In connection with Mr. Langley’s planned separation from

service with the Company, the Compensation Committee approved a severance payment of $810,000, which was equivalent to Mr.

Langley’s target cash compensation. Mr. Langley’s severance was determined in consideration of: 1) the severance guidelines for Named

Executive Officers discussed on page 48 of this Proxy Statement; 2) the Company organizational changes resulting in the elimination of

Mr. Langley’s position; and 3) the severance arrangement in Mr. Langley’s hiring agreement, which had expired a year earlier and provided

a comparable benefit. In addition to severance, the Committee granted an “approved reason” and accelerated vesting for the remaining