Kodak 2008 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

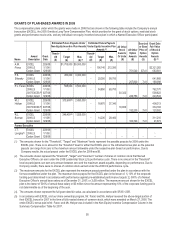

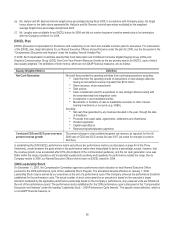

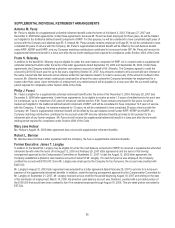

SUPPLEMENTAL INDIVIDUAL RETIREMENT ARRANGEMENTS

Antonio M. Perez

Mr. Perez is eligible for a supplemental unfunded retirement benefit under the terms of his March 3, 2003, February 27, 2007 and

December 9, 2008 letter agreements. Under these agreements, because Mr. Perez has been employed for three years, he will be treated

as if eligible for the traditional defined benefit component of KRIP. For this purpose, he will be considered to have completed eight years of

service with the Company and attained age 65. If, instead, Mr. Perez actually remains employed until age 65, he will be considered to have

completed 25 years of service with the Company. Mr. Perez’s supplemental retirement benefit will be offset by his cash balance benefit

under KRIP, KERIP and KURIP, and any Company matching contributions contributed to his account under SIP. Mr. Perez will receive his

supplemental retirement benefit in a lump sum after the six-month waiting period required for compliance under Section 409A of the Code.

Frank S. Sklarsky

In addition to the benefit Mr. Sklarsky may be eligible for under the cash balance component of KRIP, he is covered under a supplemental

unfunded retirement benefit under the terms of his letter agreements dated September 19, 2006 and September 26, 2006. Under these

agreements, the Company established a phantom cash balance account on behalf of Mr. Sklarsky. The Company agreed to credit the

account by $100,000 each year for up to five years, beginning October 30, 2007. Any amounts credited to this account will earn interest at

the same interest rate that amounts accrue interest under the cash balance benefit. In order to receive any of the amounts credited to this

account, Mr. Sklarsky must remain continuously employed for at least five years unless the Company terminates his employment for a

reason other than cause. Upon termination of employment, any vested amount will be payable in a lump sum after the six-month waiting

period required for compliance under Section 409A of the Code.

Philip J. Faraci

Mr. Faraci is eligible for a supplemental unfunded retirement benefit under the terms of his November 3, 2004, February 28, 2007 and

December 9, 2008 letter agreements. Under these agreements, he is eligible to receive an extra 1.5 years of credited service for each year

he is employed, up to a maximum of 20 years of enhanced credited service. If Mr. Faraci remains employed for five years, he will be

treated as if eligible for the traditional defined benefit component of KRIP, and will be considered to have completed 12.5 years of service

with the Company. If, instead, he remains employed for 12 years, he will be considered to have completed 30 years of service with the

Company. Mr. Faraci’s supplemental retirement benefit will be offset by his cash balance benefit under KRIP, KERIP and KURIP, any

Company matching contributions contributed to his account under SIP and any retirement benefits provided to him pursuant to the

retirement plan of any former employer. Mr. Faraci he will receive his supplemental retirement benefit in a lump sum after the six-month

waiting period required for compliance under Section 409A of the Code.

Mary Jane Hellyar

Ms. Hellyar’s August 18, 2006 letter agreement does not provide supplemental retirement benefits.

Robert L. Berman

Mr. Berman does not have a letter agreement with the Company. He has no supplemental retirement benefits.

Former Executive: James T. Langley

In addition to the benefit Mr. Langley may be eligible for under the cash balance component of KRIP, he received a supplemental unfunded

retirement benefit under the terms of his August 12, 2003 and February 28, 2007 letter agreements and the terms of his leaving

arrangement approved by the Compensation Committee on September 21, 2007. Under the August 12, 2003 letter agreement, the

Company established a phantom cash balance account on behalf of Mr. Langley. For each full year he was employed, the Company

credited the account with $100,000. Since Mr. Langley was employed by the Company for four full years, the account was credited with

$400,000.

Mr. Langley’s August 12, 2003 letter agreement was amended by a letter agreement dated February 28, 2007 to provide for a lump-sum

payment of his supplemental retirement benefits. In addition, under the leaving arrangement approved by the Compensation Committee for

Mr. Langley on September 21, 2007, Mr. Langley received service credit for the period beginning August 18, 2007 and ending on the date

of his termination of employment, March 14, 2008. His phantom cash balance account was, therefore, credited with a pro-rated portion of

the $100,000 that would have been credited to him if he remained employed through August 18, 2008. This pro-rated portion amounted to

$57,534.