Kodak 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

NOTE 18: OTHER POSTRETIREMENT BENEFITS

The Company provides healthcare, dental and life insurance benefits to U.S. eligible retirees and eligible survivors of retirees.

Generally, to be eligible for the plan, individuals retiring prior to January 1, 1996 were required to be 55 years of age with ten years

of service or their age plus years of service must have equaled or exceeded 75. For those retiring after December 31, 1995, the

individuals must be 55 years of age with ten years of service or have been eligible as of December 31, 1995. Based on the eligibility

requirements, these benefits are provided to U.S. retirees who are covered by the Company's KRIP plan and are funded from the

general assets of the Company as they are incurred. However, those under the Cash Balance Plus portion of the KRIP plan would

be required to pay the full cost of their benefits under the plan.

On August 1, 2008, the Company adopted and announced certain changes to its U.S. postretirement benefit plan affecting its post-

September 1991 retirees beginning January 1, 2009. For affected participants, the terms of the amendment reduce the Company’s

contribution toward retiree medical coverage from its 2008 level by one percentage point per year for a 10-year period, phase-out

Company contributions for dependent medical coverage over the same 10-year period with access only coverage beginning in 2018,

and discontinue retiree dental coverage and Company-paid life insurance.

The changes made to the plan resulted in the remeasurement of the plan’s obligations as of August 1, 2008, the date the changes

were adopted and announced by the Company. This remeasurement reduced the Company’s other postretirement benefit obligation

by $919 million, of which $772 million is attributable to the plan changes. In addition, the Company recognized a curtailment gain of

$79 million as a result of the amendment. The curtailment gain was included in Cost of goods sold, Selling, general and

administrative expenses, and Research and development costs in the Consolidated Statement of Operations for the year ended

December 31, 2008.

The Company’s benefits to U.S. long-term disability recipients were also amended as described above. These changes resulted in a

reduction in Pension and other postretirement liabilities, and a corresponding gain of $15 million was included in the Cost of goods,

Selling general and administrative expenses, and Research and development costs in the Consolidated Statement of Operations for

the year ended December 31, 2008.

The Company's subsidiaries in the United Kingdom and Canada offer similar healthcare benefits.

The measurement date used to determine the net benefit obligation for the Company's other postretirement benefit plans is

December 31.

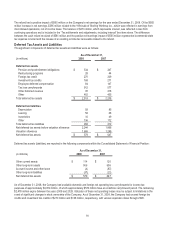

Changes in the Company’s benefit obligation and funded status for the U.S., United Kingdom and Canada other postretirement

benefit plans were as follows:

(in millions) 2008

2007

Net benefit obligation at beginning of year $ 2,524

$ 3,009

Service cost 4

8

Interest cost 136

165

Plan participants’ contributions 26

25

Plan amendments (825)

(88)

Actuarial gain (141)

(317)

Acquisitions/divestitures 2

(9)

Settlements (2)

(37)

Benefit payments (230)

(243)

Currency adjustments (23)

11

Net benefit obligation at end of year $ 1,471

$ 2,524

Underfunded status at end of year $ (1,471)

$ (2,524)