Kodak 2008 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

in 2007 in the form of fully-vested shares of common stock, which were settled on March 27, 2008. Named Executive Officers did

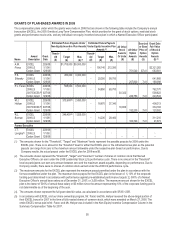

not receive any non-equity incentive compensation in 2006 and 2008 because no EXCEL awards were earned for those years.

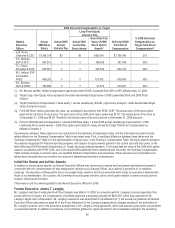

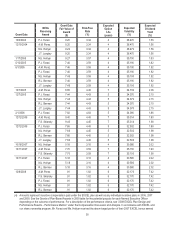

(5) This column reports the aggregate change in the present value of the Named Executive Officer's accumulated benefits under

KRIP, KURIP and supplemental individual retirement arrangements, to the extent a Named Executive Officer participates, and

the estimated above-market interest, if any, earned during the year on deferred compensation balances. The breakdown of these

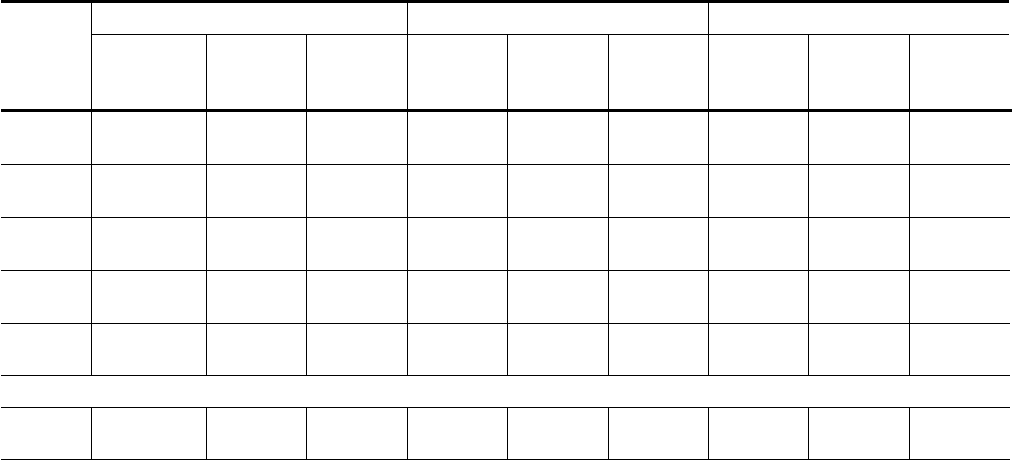

figures is shown in the table below:

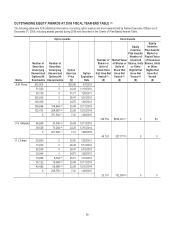

2006 2007 2008

Executive Pension

Value

Above-

Market

Interest (a)

Total

Value

Pension

Value

Above-

Market

Interest (a)

Total

Value

Pension

Value(b)

Above-

Market

Interest (a)

Total

Value

A.M.

Perez $3,192,022 $22,576 $3,214,598 $491,469 $28,091 $519,560 $3,434,567 $3,728 $3,438,295

F.S.

Sklarsky 18,303 — 18,303 104,165 —104,165 119,720 — 119,720

P.J.

Faraci 319,305 — 319,305 386,094 —386,094 341,208 — 341,208

M.J.

Hellyar 1,098,877 3,553 1,102,430 0 4,093 4,093 0 517 517

R.L.

Berman N/A N/A N/A N/A N/A N/A 98,186 2,571 100,757

Former Executive

J.T.

Langley 144,232 26,928 171,160 167,844 44,225 212,069 110,470 5,823 116,293

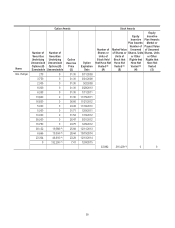

(a) A Named Executive Officer’s deferral account balances are credited with interest at the “prime rate” as reported in the

Wall Street Journal, compounded monthly. Above-market interest is calculated as the difference between the prime

rate and 120% of the Applicable Federal Rate (AFR) for the corresponding month.

(b) With the exception of Mr. Perez, the 2008 Pension Values are generally consistent with the 2007 Pension Values. Mr.

Perez’s 2008 Pension Value increased primarily due to the EXCEL bonus paid in 2008 (earned in 2007), as well as

changes in actuarial assumptions. The primary actuarial assumption changes were an increase in the discount rate, a

decrease in the lump sum interest rate, and an update to the lump sum mortality table. Due to the fact that Mr. Perez is

close to age 65, the upward influence of the lump sum assumption changes greatly outweighed the downward

influence of the increased discount rate. Neither Mr. Sklarsky nor Mr. Faraci were significantly impacted by the

assumption changes due to their ages and specific pension provisions. Both Ms. Hellyar and Mr. Berman were

impacted by the KURIP plan amendment to require distribution in the form of a lump sum, which eliminated potential

early retirement subsidies. The KURIP amendment was adopted to comply with the terms of Section 409A of the Code,

which triggers immediate taxation on deferred compensation if the receiving employee has control over the form of

payment. To avoid this tax implication, KURIP now requires all participants to take their benefit in the form of a lump

sum. For participants covered by the traditional defined benefit component of KURIP, such as Ms. Hellyar and Mr.

Berman, the change eliminated potential early retirement subsidies that were only available if an annuity form of benefit

was chosen. The plan change reduced Ms. Hellyar’s pension value by $177,018 from last year and Mr. Berman’s

pension value by $64,154 from last year. Due to this plan change and the change in assumptions, Ms. Hellyar had

negative pension values for 2008 so her accrual for 2008, in total, was ($210,064). Despite the KURIP amendment and

the assumption changes, Mr. Berman still had a positive pension accrual for 2008, which totaled $98,186.