Kodak 2008 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

may decide whether to increase or decrease the amount of the corporate funding pool; positive discretion, however, may not increase the

size of a Named Executive Officer’s award above the maximum award level established under the plan. The maximum award under the

plan for any Named Executive Officer is the lesser of 10% of the corporate award pool (without discretion), or 500% of his or her prior year-

end base salary, not to exceed $5 million. In addition, the Committee may also choose to exercise discretion to recognize circumstances

such as unanticipated economic or market changes, extreme currency exchange effects and management of significant workforce issues.

Following its determination regarding the size of the corporate funding pool for the year, the Committee determines the amount of any

awards for the Named Executive Officers.

EXCEL Target Opportunity

As noted above, our Named Executive Officers are assigned target opportunities based on a percentage of base salary. Since a Named

Executive Officer’s EXCEL opportunity is a component of total direct compensation, the Committee annually reviews survey data to

determine the position of each Named Executive Officer’s target opportunity relative to the market.

Committee Decision and Analysis

For 2008, the target EXCEL opportunities as a percent of base salary for our Named Executive Officers were: 155% for Mr. Perez, 85% for

Mr. Faraci, 75% for Mr. Sklarsky, and 65% for Ms. Hellyar and Mr. Berman (changed from 62% to 65% effective May 12, 2008). The target

EXCEL opportunity for our Named Executive Officers, other than Ms. Hellyar and Mr. Berman, remained unchanged from 2007 because

the Committee felt that each executive’s target total cash position was appropriately positioned against the market median. Ms. Hellyar’s

target opportunity was increased by 3% to recognize her increase in responsibilities as President FPEG and to move her total direct

compensation to market median. Mr. Berman’s target opportunity was also increased by 3% to maintain internal equity in target EXCEL

opportunities and to more closely align his target total cash to market median.

For 2009, the Committee determined that the target EXCEL opportunity for our Named Executive Officers will remain unchanged due to

the challenging economic environment and management’s decision to provide no salary and no annual variable pay target opportunity

increase for executives.

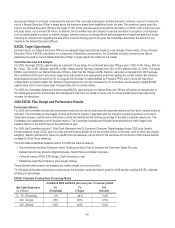

2008 EXCEL Plan Design and Performance Results

Performance Metrics

For 2008, the Committee selected two performance metrics to be used to determine the corporate award pool from which awards would be

allocated. The Committee set the targets of these performance metrics in alignment with the Company’s external guidance to investors.

Using these targets, a performance matrix was created that determined the funding percentage of the plan’s corporate award pool. The

Committee also established a set of baseline metrics. The Committee reviewed and finalized these performance metric targets and

baseline metrics in the first 90 days of the performance year.

For 2008, the Committee selected: 1) Net Cash Generation and 2) Combined Consumer Digital Imaging Group (CDG) and Graphic

Communications Group (GCG) year-over-year percent revenue growth as the two primary metrics for the plan, each of which was equally

weighted. Specific definitions for these non-GAAP financial measures can be found in the narratives for the Grants of Plan-based Awards

on page 55 of this Proxy statement.

The Committee established baseline metrics for 2008 that were focused on:

• Key market introductions (Consumer Inkjet, Continuous Inkjet, Drop on Demand and Consumer Digital Dry Lab);

• Market share for key products (Digital Cameras, Digital Plates and Digital Scanners);

• Financial metrics (FPEG EFO Margin, Cash Conversion); and

• Milestones under the Company’s grow people strategy.

These baseline metrics were not assigned any relative weight vis-à-vis each other.

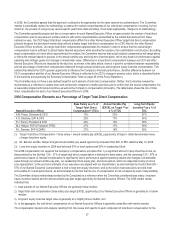

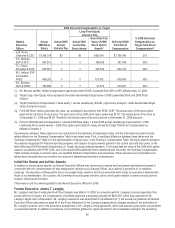

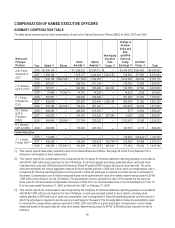

The following abbreviated performance matrix shows the threshold, target and stretch goals for 2008 and the resulting EXCEL corporate

funding pool percentage:

EXCEL Corporate Funding Pool Percentage Matrix

Combined CDG and GCG year-over-year % revenue growth

Net Cash Generation

(in millions)

4%

(Threshold)

7%

(Target)

10%

(Stretch)

$ 50 (Threshold) 11% 44% 114%

300 (Target) 67% 100% 170%

500 (Stretch) 120% 144% 214%