Kodak 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

Environmental expenditures that relate to an existing condition caused by past operations and that do not provide future benefits are

expensed as incurred. Costs that are capital in nature and that provide future benefits are capitalized. Liabilities are recorded when

environmental assessments are made or the requirement for remedial efforts is probable, and the costs can be reasonably

estimated. The timing of accruing for these remediation liabilities is generally no later than the completion of feasibility studies. The

Company has an ongoing monitoring and identification process to assess how the activities, with respect to the known exposures,

are progressing against the accrued cost estimates, as well as to identify other potential remediation sites that are presently

unknown.

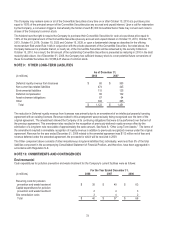

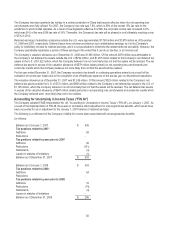

At December 31, 2008 and 2007, the Company’s undiscounted accrued liabilities for environmental remediation costs amounted to

$115 million and $125 million, respectively. These amounts were reported in Other long-term liabilities in the accompanying

Consolidated Statement of Financial Position.

The Company is currently implementing a Corrective Action Program required by the Resource Conservation and Recovery Act

(“RCRA”) at Eastman Business Park (formerly known as Kodak Park) in Rochester, NY. The Company is currently in the process of

completing, and in many cases has completed, RCRA Facility Investigations (“RFI”), Corrective Measures Studies (CMS) and

Corrective Measures Implementation (“CMI”) for areas at the site. At December 31, 2008, estimated future investigation and

remediation costs of $63 million were accrued for this site, the majority of which relates to long-term operation, maintenance of

remediation systems and monitoring costs.

In addition, the Company has accrued for obligations with estimated future investigation, remediation and monitoring costs of $12

million relating to other operating sites, $21 million at sites associated with former operations, and $19 million of retained obligations

for environmental remediation and Superfund matters related to certain sites associated with the non-imaging health businesses sold

in 1994.

Cash expenditures for the aforementioned investigation, remediation and monitoring activities are expected to be incurred over the

next twenty-seven years for many of the sites. For these known environmental liabilities, the accrual reflects the Company’s best

estimate of the amount it will incur under the agreed-upon or proposed work plans. The Company’s cost estimates were determined

using the ASTM Standard E 2137-06, "Standard Guide for Estimating Monetary Costs and Liabilities for Environmental Matters," and

have not been reduced by possible recoveries from third parties. The overall method includes the use of a probabilistic model which

forecasts a range of cost estimates for the remediation required at individual sites. The projects are closely monitored and the

models are reviewed as significant events occur or at least once per year. The Company’s estimate includes investigations,

equipment and operating costs for remediation and long-term monitoring of the sites. The Company does not believe it is reasonably

possible that the losses for the known exposures could exceed the current accruals by material amounts.

A Consent Decree was signed in 1994 in settlement of a civil complaint brought by the U.S. Environmental Protection Agency

(“EPA”) and the U.S. Department of Justice. In connection with the Consent Decree, the Company is subject to a Compliance

Schedule, under which the Company has improved its waste characterization procedures, upgraded one of its incinerators, and has

upgraded its industrial sewer system. The Company submitted a certification stating that it has completed the requirements of the

Consent Decree, and expects to receive an acknowledgement of completion from the EPA in the first quarter of 2009. No further

capital expenditures are expected under this program, but Kodak is required to continue the sewer inspection program until the

Decree is closed by the Court. Costs associated with the sewer inspection program are not material.

The Company is presently designated as a potentially responsible party (“PRP”) under the Comprehensive Environmental

Response, Compensation and Liability Act of 1980, as amended (the “Superfund Law”), or under similar state laws, for

environmental assessment and cleanup costs as the result of the Company’s alleged arrangements for disposal of hazardous

substances at eight Superfund sites. With respect to each of these sites, the Company’s liability is minimal. In addition, the

Company has been identified as a PRP in connection with the non-imaging health businesses in two active Superfund sites.

Numerous other PRPs have also been designated at these sites. Although the law imposes joint and several liability on PRPs, the

Company’s historical experience demonstrates that these costs are shared with other PRPs. Settlements and costs paid by the

Company in Superfund matters to date have not been material. Future costs are also not expected to be material to the Company’s

financial position, results of operations or cash flows.

Uncertainties associated with environmental remediation contingencies are pervasive and often result in wide ranges of outcomes.

Estimates developed in the early stages of remediation can vary significantly. A finite estimate of costs does not normally become

fixed and determinable at a specific time. Rather, the costs associated with environmental remediation become estimable over a

continuum of events and activities that help to frame and define a liability, and the Company continually updates its cost estimates.

The Company has an ongoing monitoring and identification process to assess how the activities, with respect to the known

exposures, are progressing against the accrued cost estimates, as well as to identify other potential remediation issues.