Kodak 2008 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

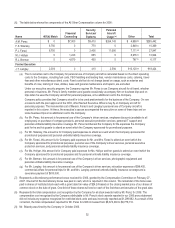

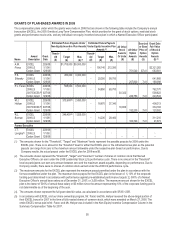

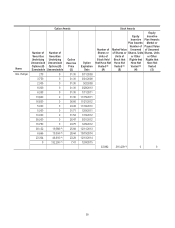

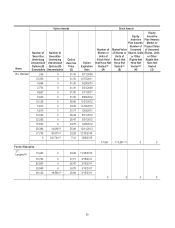

(10) Represents a discretionary bonus received for 2006 pursuant to the terms of Mr. Sklarsky's offer letter dated September 19,

2006.

(11) Mr. Langley’s employment with the Company terminated on March 14, 2008.

(12) Includes a severance payment of $810,000 in connection with the termination of Mr. Langley’s employment with the Company.

(13) Mr. Langley’s amount for 2007 included $212,250 paid under his individual bonus plan and $573,500 paid under EXCEL.

(14) Includes a $25,000 payment, a portion of a sign-on bonus, per Mr. Langley's August 2003 agreement, and a discretionary

performance bonus received for 2006, granted by the Compensation Committee on February 27, 2007. One-half of the

discretionary bonus was paid in cash, which is reported in this column. The remainder of the bonus was paid in shares of

restricted stock, each with a grant date fair value of $24.24 based on the closing market price of our common stock on the grant

date. One-third of these shares will vest on each of the first three anniversaries of the grant date. The number of restricted

shares awarded is shown in the Grants of Plan-Based Awards in the Company’s 2008 Proxy Statement.

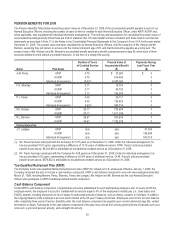

EMPLOYMENT AND RETENTION ARRANGEMENTS

The material terms of each Named Executive Officer’s employment or retention arrangements with the Company are described below. The

levels of salary, annual variable incentive compensation and long-term equity-based incentive compensation as well as the material

considerations that the Compensation Committee takes into account in establishing those levels are described in the Compensation

Discussion and Analysis on page 34 of this Proxy Statement.

Antonio M. Perez

The Company employed Mr. Perez as President and COO under a letter agreement dated March 3, 2003. On May 10, 2005, in connection

with Mr. Perez’s election as Chief Executive Officer and Chairman of the Board, the Compensation Committee modified the compensation-

related terms of his employment. In addition to the compensation described elsewhere in this Proxy Statement, Mr. Perez is eligible to

receive a base salary of $1.1 million and a target award under the EXCEL plan of 155% of his base salary. Mr. Perez is eligible to

participate in all incentive compensation, retirement, supplemental retirement and deferred compensation plans, policies and arrangements

that are provided to other senior executives of the Company.

Under his March 3, 2003 letter agreement, Mr. Perez is also eligible to receive a supplemental unfunded retirement benefit, which is

described on page 65 of this Proxy Statement. Mr. Perez’s letter agreement was amended by a letter agreement dated February 27, 2007

to provide that this supplemental retirement benefit will vest when he turns age 65, consistent with the Company’s mandatory retirement

policy for our corporate officers. This February 27, 2007 letter agreement also provides lump sum payment of his supplemental retirement

benefit following the six-month anniversary of his termination. Mr. Perez’s letter agreement was further amended by a letter agreement

dated December 9, 2008 to specify how his surviving spouse’s pre-retirement survivor benefits related to his supplemental unfunded

retirement benefit will be calculated, clarify what persons qualify as survivors, and provide for payment of pre-retirement survivor benefits in

the form of a lump sum. With respect to the calculation of his surviving spouse’s pre-retirement survivor benefits, Section 409A of the Code

triggers immediate taxation on Mr. Perez’s deferred compensation if his surviving spouse has control over which of two formulas would be

used for this calculation. To avoid this tax implication, the December 9, 2008 letter agreement requires the surviving spouse’s pre-

retirement survivor benefits to be the greater of the benefits calculated using either formula. With regard to the definition of survivor, the

December 9, 2008 letter agreement clarifies that the only persons who qualify as survivors include Mr. Perez’s surviving spouse or

domestic partner and, if none, his surviving child(ren) under age 19. This definition was added because both his March 3, 2003 and

February 27, 2007 letter agreements did not specify the intended meaning of the term survivor. With regard to the lump sum payment of

pre-retirement survivor benefits, the December 9, 2008 letter agreement provides for a form of payment because one was not specified in

Mr. Perez’s March 3, 2003 and February 27, 2007 letter agreements. A lump sum form of payment was selected because it is consistent

with the form of payment provided for Mr. Perez’s supplemental unfunded retirement benefit under his February 27, 2007 letter agreement.

The term of Mr. Perez’s employment is indefinite but, according to his March 3, 2003 letter agreement, as amended by his December 9,

2008 letter agreement, he will be eligible to receive certain severance benefits in connection with termination of his employment under

various circumstances. For information regarding his potential severance payments and benefits, please read the narrative descriptions

and tables beginning on page 69 of this Proxy Statement.

Frank S. Sklarsky

The Company employed Mr. Sklarsky as Chief Financial Officer under a letter agreement dated September 19, 2006. In addition to the

compensation described elsewhere in this Proxy Statement, his letter agreement provides that Mr. Sklarsky is eligible to receive a base

salary of $600,000 and a target award under the EXCEL plan of 75% of his base salary. He is also eligible under his letter agreement to

participate in the annual Corporate Officer stock option program with a target value of approximately $800,000 and the annual Leadership

Stock Program with a target value of approximately $800,000. The letter agreement was amended by a letter agreement dated September

26, 2006 to provide that Mr. Sklarsky was eligible to receive a cash award equal to $75,000, less any amount actually received under the

EXCEL plan for the 2006 performance period. Mr. Sklarsky is eligible to participate in all incentive compensation, retirement, supplemental

retirement and deferred compensation plans, policies and arrangements that are provided to other senior executives of the Company.