Kodak 2008 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

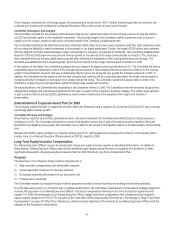

Policy on Qualifying Compensation

When designing all aspects of compensation, the Company considers the deductibility of executive compensation under Section 162(m) of

the Code, which provides that the Company may not deduct compensation of more than $1 million paid to certain executives, other than

“performance-based” compensation meeting certain requirements. Annual variable pay under our EXCEL plan is designed to satisfy the

requirements for “performance-based” compensation as defined in Section 162(m) of the Code. Stock options and Leadership Stock are

also intended to satisfy the requirements for “performance-based” compensation under Section 162(m). While we design these plans to

operate in a manner that is intended to qualify as “performance-based” under Section 162(m), the Committee may administer the plans in

a manner that does not satisfy the requirements of Section 162(m) in order to achieve a result that the Committee determines to be

appropriate.

While the Committee considers the impact of the tax treatment, the primary factor influencing program design is the support of business

objectives. Generally, whether or not compensation will be deductible under Section 162(m) will be an important, but not the decisive

factor, with respect to the Committee’s compensation determinations. In 2008 the Committee recognized that, while both stock options and

Leadership Stock are 162(m) compliant, restricted stock units are not. The Committee nonetheless determined that the benefit to be

derived from restricted stock units, namely their retentive value, outweighed any impact resulting from the inability to claim a deduction

under Section 162(m) of the Internal Revenue Code.

Policy on Recoupment of Bonuses

The Company has a policy regarding the recoupment of bonuses in the event of financial restatements. Under this policy, the Board may

seek to recover, to the extent permitted under applicable local law, any performance-based pay awarded to a Named Executive Officer

under EXCEL if an executive’s fraud or misconduct caused or partially caused the need for significant financial restatement and if the

bonuses would have been lower as a result of the restatement. The policy is more fully discussed on page 20 of this Proxy Statement.

OTHER COMPENSATION ELEMENTS

Retirement Plans

The Company offers a tax-qualified defined benefit plan comprised of a cash balance component and a traditional defined benefit

component (KRIP) and tax-qualified 401(k) defined contribution plan (SIP), which cover virtually all U.S. employees. In addition to these

tax-qualified retirement plans, the Company provides supplemental non-qualified retirement benefits to our Named Executive Officers

under the Kodak Unfunded Retirement Income Plan (KURIP) and the Kodak Excess Retirement Income Plan (KERIP). KURIP and KERIP

are unfunded retirement plans that are designed to provide our executives with pension benefits that make up for the Code’s limitations on

allocations and benefits that may be paid under KRIP and SIP. None of our Named Executive Officers has an accumulated benefit under

KERIP. The details of KRIP and KURIP are described under the Pension Benefits Table on page 63 of this Proxy Statement.

The Company believes that our tax-qualified retirement plans and non-qualified supplemental retirement plans enhance our executive

compensation package. The primary objective of our retirement plans is to attract and retain our employees.

Supplemental Individual Retirement Arrangements

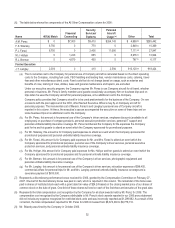

We have also entered into individual letter agreements with Messrs. Perez, Faraci and Sklarsky to provide additional retirement benefits

beyond those available under our tax-qualified retirement plans and non-qualified supplemental retirement plans. For Messrs. Perez and

Faraci, these agreements provide for additional years of service in calculating their benefits under KRIP and KURIP. Supplemental

individual retirement arrangements were necessary to recruit these Named Executive Officers. The benefits provided to our Named

Executive Officers under any individual retirement arrangement are described on page 65 of this Proxy Statement.

Deferred Compensation Plan

The Company maintains a non-qualified deferred compensation plan for its executives, known as the Eastman Kodak Company 1982

Executive Deferred Compensation Plan (EDCP). The plan permits the Company’s executives to defer a portion of their base salary and

annual bonus awards. Each fall, the Company’s executives may elect to defer base salary for the following year and up to a portion of any

bonus earned under EXCEL the following year. The plan is intended to promote retention by providing our executives with a long-term

savings opportunity on a tax-deferred basis. The details of this plan are described under the Non-Qualified Deferred Compensation Table

on page 66 of this Proxy Statement. In 2008, the Committee froze the receipt of new monies into this plan. This action was taken due to

the plan’s low utilization and administrative costs.

Perquisites

The Company provides certain perquisites primarily for security related reasons, to maximize an executive’s time spent on Company

business or to attract and retain our Named Executive Officers. The primary perquisites that our Named Executive Officers receive are

financial counseling services, personal umbrella liability insurance coverage and occasional use of the Company’s driver service. Home

security services are provided for Mr. Perez but were discontinued in December 2008 for Messrs. Faraci, Sklarsky and Berman and in

January 2009 for Ms. Hellyar. The Company’s driver service was discontinued for all Named Executive Officers in October 2008. The

elimination of these perquisites is in addition to the discontinuation of executive physicals in December 2007.