Kodak 2008 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

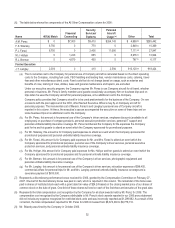

3,453 restricted shares of the Company’s stock granted to Mr. Langley on February 27, 2007 as a performance award. The Committee felt

it was appropriate to accelerate vesting on the remaining shares given that these shares were granted to recognize 2006 results. Finally,

for purposes of Mr. Langley’s supplemental unfunded retirement benefit, the Committee determined that Mr. Langley would receive service

credit for the period beginning August 18, 2007 and ending on March 14, 2008, and, therefore, he would receive a pro-rated portion of the

$100,000 that would have been credited to him had he remained employed through August 18, 2008.

Given that Mr. Langley’s last day of work was planned for the first quarter of 2008, the Committee determined that Mr. Langley would not

receive an annual stock option grant in 2007 or a 2008 Leadership Stock grant, nor would he be eligible for a base salary increase or an

EXCEL award for the 2008 performance year.

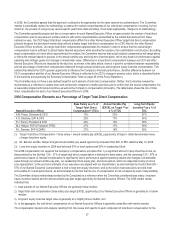

EXECUTIVE COMPENSATION POLICIES RELATING TO INCENTIVE PLANS

Share Ownership Program

Under our Share Ownership Program, our Section 16 Executive Officers are expected, over time, to acquire a significant ownership stake

in the Company equal to at least one to five times their base salary amounts, depending on the executive’s position. Details regarding this

program are on page 30 of this Proxy Statement. The Committee believes this program furthers its objective of closely aligning the

interests of our executives with those of our shareholders. The Committee plans to revisit the terms of the Share Ownership Program

during 2009.

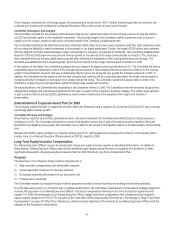

Equity Award Policy

All equity awards granted to Named Executive Officers in 2008 were granted in accordance with our Board of Directors Policy on Equity

Awards approved by the Board effective as of January 1, 2007. In accordance with this policy, our grant timing guidelines are as follows:

Annual Stock Option Award. Annual grants of stock options are approved at the Committee’s regularly scheduled December meeting. If

grants of stock options are to be awarded, the grant date for such options will be the date of the December meeting in which the grants

were approved.

Grant Dates for Ad Hoc and New Hire Equity Awards. For awards to Section 16 Executive Officers, the grant date for any ad hoc or

new hire equity award approved in a meeting of the Committee will be:

• The date of the Committee meeting in which the award is approved in the case of an ad hoc equity award; or

• The next regularly scheduled Committee meeting following the first date of employment in the case of an equity award to a new

hire.

The grant date of any ad hoc or new hire equity award approved by unanimous written consent of the Committee will be the next regularly

scheduled Committee meeting following:

• The date of execution of the unanimous consent in the case of an ad hoc equity award; or

• The first date of employment in the case of an equity award to a new hire.

The exercise price of any stock options awarded will be the fair market value (defined as the average of the high and low value) of the

Company’s common stock on the grant date as defined in the applicable equity compensation plan.

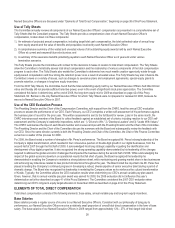

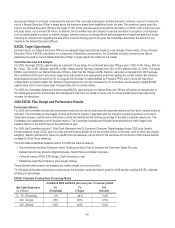

Methodology for converting dollar-denominated annual long-term incentive target opportunity into share equivalents

In December of each year, the Committee determines the target dollar value to be delivered in long-term equity incentives for each Named

Executive Officer. To determine the number of stock options to be delivered, the average of the closing price of Kodak stock over 60

trading days ending on the last trading day of September is calculated. A Black-Scholes value is then calculated using the 60-day average

stock price determined above. The target dollar value to be delivered in stock options (50% of the target total long-term equity value) is

divided by the Black-Scholes value to determine the number of stock options, which may then be rounded to the nearest reasonable whole

number. The stock option grant price is the fair market value of the Company’s stock on the grant date. The number of full value shares,

Leadership Stock and/or restricted stock units are calculated using the intended dollar value (50% of the target total long-term equity value)

divided by the average of the closing price of Kodak stock over the 60 trading days ending on the last trading day of September.

This same methodology is used annually to determine the number of stock options and shares of restricted stock to be granted to the

directors under the Director Compensation Program.

This methodology was selected for administrative purposes and so that short-term fluctuations in stock price would not impact the

conversion from dollar-denominated awards to shares. A change to the 60-day methodology was discussed as part of the annual strategy

review, but since the strategy review took place during the 60-day period it was determined appropriate to continue this methodology for

2008 and revisit it again in 2009. Use of this approach in 2008 resulted in granting equity value equal to approximately 33% of the intended

equity value because the Company’s stock price fell after determination of the 60-day average stock price and prior to the issuance of the

equity awards.