Kodak 2008 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

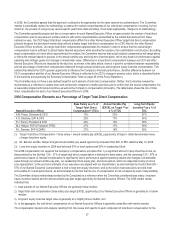

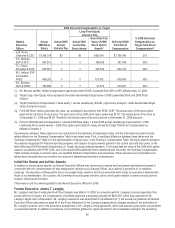

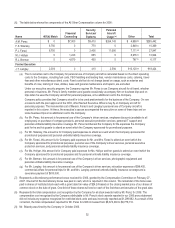

Mix of Long-Term Equity Incentive Compensation

The Committee has no pre-determined mix of the form of long-term equity incentives granted to our Named Executive Officers. In

December 2008, the Committee determined, based on the analysis discussed below, that the equity compensation program for 2009

would deliver:

• 50% of the equity dollar value in the form of stock options;

• 25% of the equity dollar value in the form of Leadership Stock; and

• 25% of the equity dollar value in the form of restricted stock units.

The stock options vest in substantially equal annual installments over a three-year period. Leadership Stock program awards are granted

in the form of performance stock units, which, if earned, are paid in the form of shares of common stock upon fulfilling a two-year vesting

period which follows a one-year performance period. The performance goals for the Leadership Stock program are established each year,

providing flexibility to the Committee to design a pay-for-performance plan that rewards achievement of key financial and/or operational

metrics. Awards delivered in restricted stock units are paid in the form of shares of common stock when the three-year vesting period

lapses.

Committee Decision and Analysis

In determining the annual mix of the form of long-term equity for 2009, the Committee considered the following:

•Alignment with shareholders’ interests. The percentage of total direct compensation of our Named Executive Officers

delivered in the form of equity ranges from 55% - 67%. All three forms of long-term equity incentive compensation provided in

2009 (stock options, Leadership Stock, and restricted stock units) are either wholly or partially dependent on changes in share

price and, as such, support our shareholder alignment objective. The Committee recognized that stock options foster the

strongest linkage between changes in shareholder value and gains realized by our executives. Therefore, it assigned the

greatest percentage (50%) of the total equity mix to stock options. The Committee also recognized that stock options, especially

if used in isolation, can create windfalls in a rising market and may lead to gains even when operating performance is weak.

Conversely, in a declining market, it is possible for stock options to deliver little or no value even when operating performance is

strong. Stock options also create a fixed expense for the Company regardless of whether they actually deliver value to

executives and, therefore, create the possibility of incurring earnings charges for awards that may deliver little or no value. As

such, while stock options are the major form of equity compensation used for 2009, the Committee also used other awards, as

discussed below, to ensure balance in the overall program and to mitigate the impact that uncontrollable market volatility may

have on the pay realized by the Named Executive Officers.

•Retention and stock ownership. For 2009, the Committee introduced restricted stock units, with a three-year cliff vesting, as a

part of the long-term equity incentive mix. The Committee decided to introduce restricted stock units after a review of the Named

Executive Officer Tally Sheets. The Tally Sheets demonstrated that the existing outstanding equity awards held little intrinsic

value for our Named Executive Officers, even in the event of significant stock price appreciation, and therefore were not

effectively supporting the Company’s retention objectives. The introduction of restricted stock units, while limiting the upside

equity opportunity available through Leadership Stock, provides a time-based equity opportunity that is tied to stock price,

enhances stock ownership, and addresses retention. In determining the percentage of restricted stock units that should comprise

the incentive mix, the Committee sought the advice of its Consultant, who indicated that utilization of restricted stock units in the

recommended percentage (25%) was aligned with current general industry practice.

•Pay for performance. The Committee continued the use of Leadership Stock in the equity mix to link a meaningful portion of the

overall long-term incentive opportunity toward the delivery of key operating goals. This mix mitigates the impact of uncontrollable

market volatility on payouts while it strengthens the linkage between controllable performance and realized compensation. The

Committee determined a mix of 25% to be an appropriate weight, recognizing the volatility of the current economic environment

and the challenge it poses in establishing appropriate financial metrics. Leadership Stock is financially more efficient than stock

options and restricted stock units since the costs are incurred only if the underlying operating performance goals are achieved. In

addition, because Leadership Stock, like restricted stock units, is structured in whole shares (rather than just potential

appreciation in the value of underlying shares), it requires fewer shares to deliver a given level of value and thereby helps in the

management of potential share dilution (i.e., overhang).

Determining Annual Target Allocations of Long-Term Equity Incentive Compensation

The number of stock options, Leadership Stock, and restricted stock units granted to the Named Executive Officers is calculated based on

a dollar value for each executive. This dollar-denominated value is set and intended to align target total direct compensation with

approximately the market median. The Committee reviews the dollar amount and, if appropriate, adjusts it to reflect individual performance

factors. The methodology used to convert this dollar-denominated long-term equity incentive opportunity into equity grants (stock options,

leadership stock units and restricted stock units) can be found on page 46 of this Proxy Statement. The equity grants are made in

accordance with the Board of Directors Policy on Equity Awards, discussed further on page 46 of this Proxy Statement.