Kodak 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

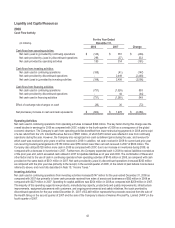

The charges, net of reversals, of $149 million recorded in 2008 included $36 million applicable to FPEG, $42 million applicable to

CDG, $49 million applicable to GCG, and $22 million that was applicable to manufacturing, research and development, and

administrative functions, which are shared across all segments.

The ongoing rationalization actions implemented in 2008 are expected to generate future annual cash savings of approximately $196

million. These savings are expected to reduce future cost of goods sold, SG&A, and R&D expenses by $97 million, $79 million, and

$20 million, respectively. The Company began realizing these savings in the first quarter of 2008, and expects the savings to be fully

realized by the end of the second quarter of 2009 as most of the actions and severance payouts are completed.

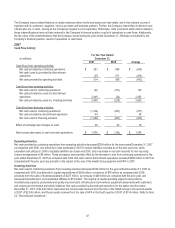

On December 17, 2008, the Company committed to a plan to implement a targeted cost reduction program (the 2009 Program) to

more appropriately size the organization as a result of the current economic environment. The program involves rationalizing selling,

administrative, research and development, supply chain and other business resources in certain areas and consolidating certain

facilities.

In connection with the 2009 Program, the Company expects to incur total restructuring charges in the range of $250 million to $300

million, including $225 million to $265 million of cash related charges for termination benefits and other exit costs, and $25 million to

$35 million of non-cash related accelerated depreciation and asset write-offs. The 2009 Program will require expenditures from

corporate cash in the range of $125 million to $175 million, as most of the termination benefits for U.S. employees will be provided in

the form of special retirement benefits (Special Termination Program (STP) benefits) payable from the Company’s over-funded U.S.

pension plan. The majority of the actions contemplated by the 2009 Program will be completed in the first half of 2009, with all

actions under the program expected to be completed by the end of 2009. The 2009 Program is expected to result in employment

reductions in the range of 2,000 to 3,000 positions when complete and yield annualized cash savings of $200 million to $250 million

in 2009 and beyond.

When combined with rationalization actions taken in late 2008, the Company expects to reduce its worldwide employment by

between 3,500 and 4,500 positions during 2009, approximately 14% to 18% of its total workforce, which are expected to generate

annual cash savings in the range of $300 million to $350 million.

For the year ended December 31, 2007, the Company incurred restructuring charges, net of reversals, of $685 million, $686 million

of which was under the 2004-2007 Restructuring Program. The $685 million of restructuring charges, net of reversals, included $23

million of costs related to discontinued operations ($20 million of severance costs and $3 million of exit costs), and $662 million

related to continuing operations ($107 million of accelerated depreciation, $12 million of inventory write-downs, $270 million of asset

impairments, $144 million of severance costs, and $129 million of exit costs). For the year ended December 31, 2006, the Company

incurred restructuring charges, net of reversals, of $768 million, all under the 2004-2007 Restructuring Program, including $70 million

related to discontinued operations ($12 million of accelerated depreciation, $3 million of inventory write-downs, $52 million of

severance costs, and $3 million of exit costs), and $698 million related to continuing operations ($273 million of accelerated

depreciation, $9 million of inventory write-downs, $88 million of asset impairments, $263 million of severance costs, and $65 million

of exit costs). The Company substantially completed its 2004-2007 Restructuring Program as of December 31, 2007.