Kodak 2008 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

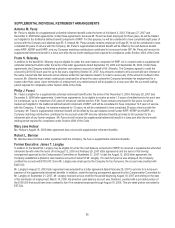

Mary Jane Hellyar

Pursuant to her August 18, 2006 letter agreement, Ms. Hellyar will be entitled to certain severance benefits if her employment is terminated

due to disability or if we terminate her employment without cause without offering her a reasonably comparable position. She will be

entitled to a severance allowance equal to two times her current annual base salary plus target EXCEL award, payable over a 12-month

period commencing after the six-month waiting period required for compliance under Section 409A of the Code. In addition to

outplacement services, she will also be entitled to fully paid continued coverage under the Kodak medical and dental plan and for basic

coverage under the Kodak Life Insurance Plan for four months.

If Ms. Hellyar’s employment is terminated without cause, Kodak will recommend that her termination be treated as an “approved reason”

with respect to any outstanding restricted shares granted in connection with her 2006 retention award. As a condition to receive these

severance benefits, Ms. Hellyar must execute a general waiver and release in favor of the Company. She will also be subject to the

restrictive covenants under the Eastman Kodak Company’s Employee’s Agreement. In the event Ms. Hellyar breaches the waiver and

release or the Eastman Kodak Company’s Employee’s Agreement, all severance payments will cease and she will be required to repay all

severance amounts previously paid by the Company.

Robert L. Berman

Mr. Berman does not have a letter agreement with the Company. His severance benefits would be provided in accordance with applicable

employee benefit and compensation plans for U.S. employees.

Former Executive: James T. Langley

Mr. Langley’s last day of employment with the Company was March 14, 2008. Under the terms of his leaving arrangement approved by the

Compensation Committee on September 21, 2007, Mr. Langley received: 1) a cash severance of $810,000, an amount equal to Mr.

Langley’s annual target total compensation; 2) “approved reason” and accelerated vesting of the 3,453 restricted shares of the Company’s

common stock granted to him on February 27, 2007 as a performance award for 2006 performance; and 3) for purposes of his

supplemental unfunded retirement benefit, Mr. Langley received service credit for the period beginning August 18, 2007 and ending of the

date of his termination of employment and, therefore, received a pro-rated portion of the $100,000 that would have been credited to him

had he remained employed through August 18, 2008.

In addition, Mr. Langley’s termination of employment was treated as an “approved reason” with respect to any unvested stock options he

held upon his termination that were granted to him earlier than one year prior to termination.

Under this August 12, 2003 letter agreement, Mr. Langley received certain relocation benefits in connection with his termination of

employment. These included the payment of expenses related to the sale of his house in Rochester, New York and the shipment of his

household goods to his permanent residence. The amount of these expenses are reported in the “All Other Compensation” column of the

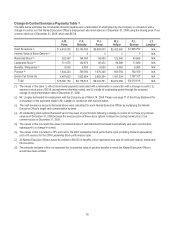

Summary Compensation Table on page 49 of this Proxy Statement.