Kodak 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

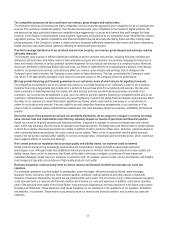

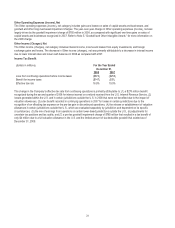

The following table shows the share repurchase activity for each of the three months in the quarter ended December 31, 2008:

(in millions, except average price paid per share)

Period

Total Number of

Shares

Purchased

Average Price

Paid per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced

Programs

Approximate Dollar

Value of Shares That

May Yet Be Purchased

under the Program

October 1, 2008 to October 31, 2008 5.6 $ 14.00 5.6 $ 702

November 1, 2008 to November 30, 2008 0.3 $ 9.61 0.3 $ 699

December 1, 2008 to December 31, 2008 - - $ 699

Total 5.9 $ 13.77 5.9

ITEM 6. SELECTED FINANCIAL DATA

Refer to Summary of Operating Data on page 103.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”) OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help

the reader understand the results of operations and financial condition of Kodak for the three years ended December 31, 2008. All

references to Notes relate to Notes to the Financial Statements in Item 8. “Financial Statements and Supplementary Data.”

Overview

Kodak is the world’s foremost imaging innovator and generates revenue and profits from the sale of products, technology, solutions

and services to consumers, businesses and creative professionals. The Company’s portfolio is broad, including image capture and

output devices, consumables and systems and solutions for consumer, business, and commercial printing applications. Kodak has

three reportable business segments, which are more fully described later in this discussion in “Kodak Operating Model and

Reporting Structure.” The three business segments are: Consumer Digital Imaging Group (“CDG”), Film, Photofinishing and

Entertainment Group (“FPEG”) and Graphic Communications Group (“GCG”).

During 2008, the Company established the following strategic objectives for the year:

• Cash generation before dividends

• Growth in revenue from the Consumer Digital Imaging Group and the Graphic Communications Group

• Growth in earnings from operations

All of the Company’s key operating metrics noted above were negatively impacted in 2008 by a dramatic decline in demand as a

result of the global economic slowdown, which accelerated late in the year. The demand for the Company’s consumer products is

largely discretionary in nature, and sales and earnings of the Company’s consumer businesses are linked to the timing of holidays,

vacations, and other leisure or gifting seasons. The fourth quarter of 2008 was marked by weak consumer holiday spending, the

impacts of which were significant in the Company’s digital camera and devices businesses in the CDG segment. In the GCG

segment, tightening credit availability, combined with the weak economy, resulted in a reduction of capital spending, negatively

impacting equipment sales as well. In addition, the reduction of global print demand had a negative impact on GCG consumables

sales, and increased costs for aluminum impacted gross margins. FPEG was also impacted by the weak economy, which

accelerated the decline of Film Capture and Traditional Photofinishing in the fourth quarter, and increased silver and petroleum-

based raw material costs impacted gross margins.

Critical Accounting Policies and Estimates

The accompanying consolidated financial statements and notes to consolidated financial statements contain information that is

pertinent to management’s discussion and analysis of the financial condition and results of operations. The preparation of financial

statements in conformity with accounting principles generally accepted in the United States of America requires management to

make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and the related

disclosure of contingent assets and liabilities.