Kodak 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Income Taxes

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, "Accounting for Uncertainty in

Income Taxes" (“FIN 48”). FIN 48 clarifies the accounting and reporting for uncertainty in income taxes recognized in accordance

with SFAS No. 109, “Accounting for Income Taxes.” This Interpretation prescribes a recognition threshold and measurement

attribute for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return, and also

provides guidance on various related matters such as derecognition, interest and penalties, and disclosure. The adoption of FIN 48

in the first quarter of 2007 did not have a material impact on the Company’s Consolidated Financial Statements.

The Company accounts for income taxes in accordance with SFAS No. 109. The asset and liability approach underlying SFAS No.

109 requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences

between the carrying amounts and tax basis of the Company’s assets and liabilities. Management provides valuation allowances

against the net deferred tax asset for amounts that are not considered more likely than not to be realized. For discussion of the

amounts and components of the valuation allowances as of December 31, 2008 and 2007, see Note 15, “Income Taxes.”

Earnings Per Share

Basic earnings per share computations are based on the weighted-average number of shares of common stock outstanding during

the year. As a result of the net loss from continuing operations presented for the years ended December 31, 2008, 2007 and 2006,

the Company calculated diluted earnings per share using weighted-average basic shares outstanding for each period, as utilizing

diluted shares would be anti-dilutive to loss per share. Weighted-average basic shares outstanding for the years ended December

31, 2008, 2007, and 2006 were 281.8 million, 287.7 million and 287.3 million shares, respectively.

The following potential shares of the Company’s common stock were not included in the computation of diluted earnings per share

for the years ended December 31, 2008, 2007 and 2006 because the Company reported a net loss from continuing operations;

therefore, the effects would be anti-dilutive:

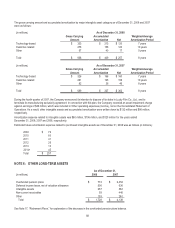

For the Year Ended December 31,

(in millions of shares) 2008 2007 2006

Employee stock options 25.2 30.9 34.6

Unvested share-based awards 0.2 0.4 0.2

Total anti-dilutive potential common shares 25.4 31.3 34.8

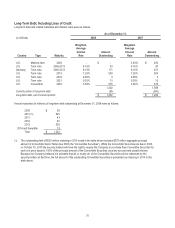

Diluted (loss) earnings per share calculations could also reflect shares related to the assumed conversion of approximately $575

million in outstanding contingent convertible notes (the “Convertible Securities”), if dilutive. The Company’s diluted (loss) earnings

per share exclude the effect of the Convertible Securities, as they were anti-dilutive for all periods presented. Refer to Note 8, “Short-

Term Borrowings and Long-Term Debt.”

Recently Issued Accounting Standards

FASB Statement No. 157

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements," which establishes a comprehensive framework for

measuring fair value and expands disclosures about fair value measurements. Specifically, this Statement sets forth a definition of

fair value, and establishes a hierarchy prioritizing the inputs to valuation techniques, giving the highest priority to quoted prices in

active markets for identical assets and liabilities and the lowest priority to unobservable inputs. The Statement defines levels within

the hierarchy as follows:

• Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the

ability to access at the measurement date.

• Level 2 inputs are inputs, other than quoted prices included within Level 1, which are observable for the asset or liability, either

directly or indirectly.

• Level 3 inputs are unobservable inputs.

The Company adopted the provisions of SFAS No. 157 for financial assets and liabilities as of January 1, 2008. There was no

significant impact to the Company’s Consolidated Financial Statements as a result of this adoption. For details on the levels at which

the Company’s financial assets and liabilities are classified within the fair value hierarchy, see Note 12, “Financial Instruments.”