Kodak 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

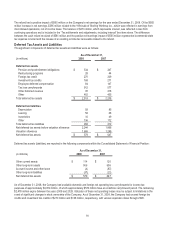

82

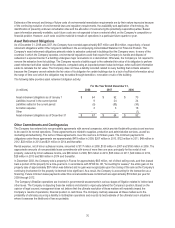

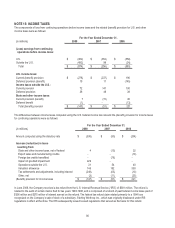

The Company has been granted a tax holiday in a certain jurisdiction in China that became effective when the net operating loss

carryforwards were fully utilized. For 2007, the Company’s tax rate was 7.5%, which is 50% of the normal 15% tax rate for the

jurisdiction in which Kodak operates. As a result of new legislation effective for 2008, the corporate income rate increased to 9%,

which was 50% of the new 2008 tax rate of 18%. Thereafter, the Company’s tax rate will be phased in until ultimately reaching a rate

of 25% in 2012.

Retained earnings of subsidiary companies outside the U.S. were approximately $1,790 million and $1,675 million as of December

31, 2008 and 2007, respectively. Deferred taxes have not been provided on such undistributed earnings, as it is the Company’s

policy to indefinitely reinvest its retained earnings, and it is not practicable to determine the related deferred tax liability. However, the

Company periodically repatriates a portion of these earnings to the extent that it can do so tax-free, or at minimal cost.

The Company’s valuation allowance as of December 31, 2008 was $1,665 million. Of this amount, $378 million was attributable to

the Company’s net deferred tax assets outside the U.S. of $722 million, and $1,287 million related to the Company’s net deferred tax

assets in the U.S. of $1,522 million, which the Company believes it is not more likely than not that the assets will be realized. The net

deferred tax assets in excess of the valuation allowance of $579 million relate primarily to net operating loss carryforwards and

certain tax credits which the Company believes it is more likely than not that the assets will be realized.

For the year ended December 31, 2007, the Company recorded a tax benefit in continuing operations primarily as a result of the

realization of current year losses due to the recognition of an offsetting tax expense on the pre-tax gain on discontinued operations.

The valuation allowance as of December 31, 2007 was $1,249 million. Of this amount, $323 million related to the Company’s net

deferred tax assets outside the U.S. of $731 million, and $926 million related to the Company’s net deferred tax assets in the U.S. of

$1,165 million, which the Company believes it is not more likely than not that the assets will be realized. The net deferred tax assets

in excess of the valuation allowance of $647 million related primarily to net operating loss carryforwards and certain tax credits which

the Company believed were more likely than not to be realized.

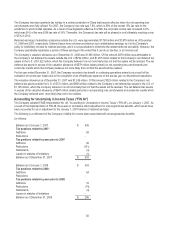

Accounting for Uncertainty in Income Taxes (“FIN 48”)

The Company adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”), on January 1, 2007. As

a result of the implementation of FIN 48, there was no cumulative effect adjustment for unrecognized tax benefits, which would have

been accounted for as an adjustment to the January 1, 2007 balance of retained earnings.

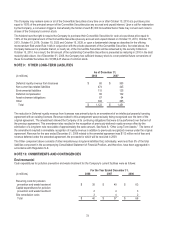

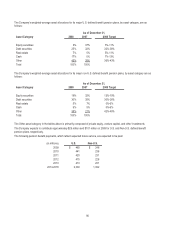

The following is a rollforward of the Company’s liability for income taxes associated with unrecognized tax benefits:

(in millions)

Balance as of January 1, 2007 $ 305

Tax positions related to 2007:

Additions 59

Reductions -

Tax positions related to years prior to 2007:

Additions 45

Reductions (101)

Settlements (4)

Lapses in statutes of limitations (1)

Balance as of December 31, 2007 $ 303

Balance as of January 1, 2008 $ 303

Tax positions related to 2008:

Additions 54

Reductions -

Tax positions related to years prior to 2008:

Additions 16

Reductions (74)

Settlements (3)

Lapses in statutes of limitations -

Balance as of December 31, 2008 $ 296