Kodak 2008 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

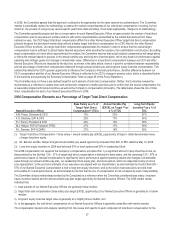

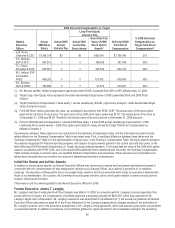

compensation, with a positive correlation between the degree of compensation at risk and the level of an executive’s responsibility, as

seen on the “2008 Compensation Element as a percentage of Total Direct Compensation” chart on page 37 of this Proxy Statement.

The Committee reviews base salaries annually at the beginning of the year, but it does not automatically increase salaries. Rather, base

salaries are adjusted if, and as, the Committee deems appropriate utilizing market median data as a reference and in consideration of: 1)

experience; 2) expanded responsibilities; 3) the importance of the position relative to other senior management positions within the

Company; 4) external relative scope or changes in the competitive marketplace; and 5) years since last base salary change. Any change in

base salary will affect an executive’s target opportunity under our annual variable pay plan, which is based on a percentage of base salary.

Committee Decision and Analysis

In making 2008 base salary decisions, the Committee determined not to increase base salaries for any Named Executive Officer. The

Committee reached this conclusion after reviewing the total direct compensation as well as base salary and target total cash compensation

of each of our Named Executive Officers against the 2007 market median data prepared by the Consultant. For those Named Executive

Officers who held their current position prior to the divestiture of the Health Group (Mr. Perez and Mr. Berman), the Committee also

considered market data for revenue reflecting the Company’s size prior to the Health Group divestiture. The Committee found the base

salary levels of our Named Executive Officers to be appropriate and competitive. The market analysis indicated that the total direct

compensation of each of our Named Executive Officers was approximately at or slightly above median, and their base salaries were

competitively positioned to median. The Committee recognized that the total direct compensation and target total cash compensation data

reflected the completion of the Company’s multi-year strategy designed to increase the proportion of our Named Executive Officer’s total

direct compensation delivered in the form of equity and decrease the proportion delivered as base salary.

For 2009, the Committee reviewed the 2008 market analysis that its Consultant prepared and considered each Named Executive Officer’s

total direct compensation, target total cash compensation and base salary in relation to the market median for comparable sized

companies and responsibilities. For those Named Executive Officers who held their current position prior to the divestiture of the Health

Group (Mr. Perez and Mr. Berman), the Committee also considered market data for revenue reflecting the Company’s size prior to the

Health Group divestiture. Further, the Committee considered the number of years since the Named Executive Officer received a base

salary increase. The CEO provided a summary of the individual’s prior year contributions and Tally Sheet as background, with the

exception of Mr. Berman, since he was not a Named Executive Officer in 2007. After this review, and based on management’s

recommendation, the Committee determined that there would be no salary increases for any Named Executive Officers. The Committee

made this decision in light of management’s recommendation, based on the severe economic environment, to provide no increases in

either base salary or annual variable pay target opportunity for executives except in limited cases where an executive makes a job change

that involves a substantial increase in responsibility.

Annual Variable Pay: EXCEL Plan

The Company provides an annual variable cash incentive opportunity to our executives, including our Named Executive Officers, through

its EXCEL plan. The purpose of EXCEL is to provide annual cash compensation based on the Company’s overall annual operating

performance, thereby 1) motivating management to pursue operational and strategic objectives deemed most critical for the Company’s

short-term success; 2) aligning realized pay with delivered performance; and 3) ensuring that costs are supported by underlying operating

results. The EXCEL plan is intended to comply with the “performance-based” compensation requirements of Section 162(m) of the Internal

Revenue Code (the Code) so that any cash incentives payable under the plan will be fully deductible by the Company to the extent

permitted under Section 162(m).

Executives participating in the plan are assigned a target opportunity expressed as a percentage of base salary. Annual cash incentives

may be awarded under the plan based on achievement of key operational performance goal(s) that the Committee establishes at the

beginning of the year. These objective measures are designed to drive Company performance. Typically, the Committee establishes

threshold, target and stretch performance goals. Payouts under EXCEL are provided through a corporate funding pool, the size of which is

based on results achieved against the goals.

If the threshold performance level is not achieved, no amounts will be paid under the plan to our Named Executive Officers. If performance

targets are exceeded, payouts may exceed an executive’s target opportunity. If a Named Executive Officer has not met his or her share

ownership guidelines, as described further on page 30 of this Proxy Statement, the amount of the EXCEL awards earned above target, if

any, will be paid in unrestricted shares of Kodak common stock to the point required to meet the ownership guideline.

The Committee also establishes a set of EXCEL baseline metrics for each performance year. These metrics are designed to provide the

Committee with additional guidance should it decide to exercise discretion to adjust (upward or downward) the size of the corporate award

pool and the amount allocated to each Named Executive Officer. These metrics reflect the key strategic and operational imperatives for the

year in support of the Company’s business strategy. The Committee selects these metrics in part to ensure that the primary EXCEL

performance metrics are not achieved at the expense of the longer-term interest of the shareholders. Typically, the baseline metrics are

not assigned any relative weight vis-à-vis each other.

After the end of the performance year, the Committee determines the extent to which the operational performance goals were achieved

and the corporate funding pool resulting from any such achievement. Based on performance against the baseline metrics, the Committee