Kodak 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

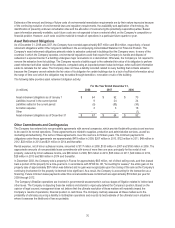

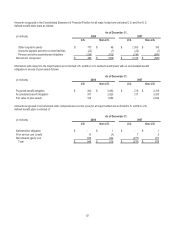

Foreign Currency Forward Contracts

The Company does not apply hedge accounting to the foreign currency forward contracts used to offset currency-related changes in

the fair value of foreign currency denominated assets and liabilities. These contracts are marked to market through net (loss)

earnings at the same time that the exposed assets and liabilities are remeasured through net (loss) earnings (both in Other income

(charges), net). The majority of the contracts of this type held by the Company are denominated in euros.

Silver Forward Contracts

The Company has entered into silver forward contracts that are designated as cash flow hedges of price risk related to forecasted

worldwide silver purchases. The fair values of silver forward contracts are reported in Other current assets and/or Accounts payable

and current liabilities, and the effective portion of the gain or loss on the derivative is recorded in Accumulated other comprehensive

income (loss). Hedge gains and losses are reclassified into Cost of goods sold as the related silver-containing products are sold to

third parties. These gains (losses) transferred to Cost of goods sold are generally offset by increased (decreased) costs of silver

purchased in the open market. As of December 31, 2008, the fair value of open silver forward contracts was an unrealized net loss

of $3 million, which is included in Accumulated other comprehensive income (loss). If this amount were to be realized, all of it would

be reclassified into Cost of goods sold during the next twelve months. Additionally, realized losses of $3 million (pre-tax), related to

closed silver contracts, have been deferred in Accumulated other comprehensive income (loss). These gains will be reclassified into

Cost of goods sold as the related silver-containing products are sold, all within the next twelve months. During 2008, realized gains

of $8 million (pre-tax) were reclassified from Accumulated other comprehensive income (loss) to Cost of goods sold. Hedge

ineffectiveness was insignificant.

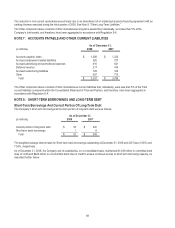

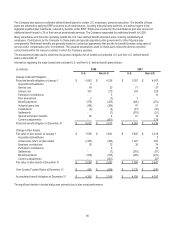

NOTE 13: OTHER OPERATING EXPENSES (INCOME), NET

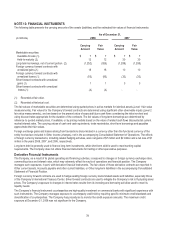

For the Year Ended December 31,

(in millions) 2008 2007 2006

Expenses (income):

Goodwill impairment (1) $ 785 $ - $ -

Long-lived asset impairments (1) 4 56 11

Gains related to the sales of assets and businesses (25) (158) (70)

Other 2 6 -

Total $ 766 $ (96) $ (59)

(1) Refer to Note 5, “Goodwill and Other Intangible Assets.”

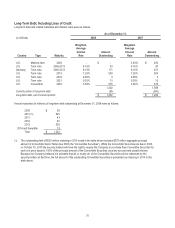

NOTE 14: OTHER INCOME (CHARGES), NET

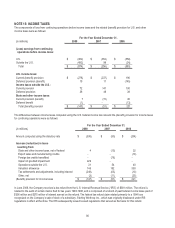

For the Year Ended December 31,

(in millions) 2008 2007 2006

Income (charges):

Interest income $ 71 $ 95 $ 59

Gain (loss) on foreign exchange transactions 7 2 (1)

Support for an educational institution (10) - -

Loss on early extinguishment of debt - - (9)

MUTEC equity method investment impairment (4) (5) -

Other (9) (5) 16

Total $ 55 $ 87 $ 65