Kodak 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

The special termination benefits of $40 million, $75 million, and $56 million for the years ended December 31, 2008, 2007, and 2006,

respectively, were incurred as a result of the Company's restructuring actions and, therefore, have been included in Restructuring

costs, rationalization and other in the Consolidated Statement of Operations for those respective periods. In addition, curtailment and

settlement gains for the major funded and unfunded U.S. and Non-U.S. defined benefit plans totaling $14 million and $0 for 2008,

$32 million and $51 million for 2007, and $50 million and $30 million for 2006 were also incurred as a result of the Company's

restructuring actions and, therefore, have been included in Restructuring costs, rationalization and other in the Consolidated

Statement of Operations for those respective periods.

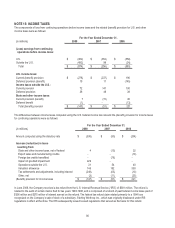

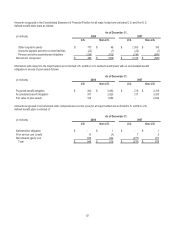

The weighted-average assumptions used to determine the benefit obligation amounts as of the end of the year for all major funded

and unfunded U.S. and Non-U.S. defined benefit plans were as follows:

As of December 31,

2008 2007

U.S. Non-U.S.

U.S.

Non-U.S.

Discount rate 7.00% 5.92%

6.50%

5.59%

Salary increase rate 4.06% 3.42%

4.43%

4.00%

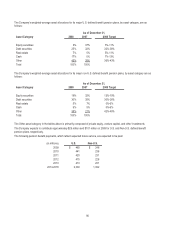

The weighted-average assumptions used to determine net pension (income) expense for all the major funded and unfunded U.S.

and Non-U.S. defined benefit plans were as follows:

For the Year Ended December 31,

2008 2007

U.S. Non-U.S.

U.S.

Non-U.S.

Discount rate 6.52% 5.77%

6.12%

5.36%

Salary increase rate 4.51% 3.93%

4.59%

3.84%

Expected long-term rate of return on plan

assets 8.99% 7.86%

8.99%

8.10%

Of the total plan assets attributable to the major U.S. defined benefit plans at December 31, 2008 and 2007, 98% relate to the Kodak

Retirement Income Plan (“KRIP”, “the Plan”). The expected long-term rate of return on plan assets assumption (“EROA”) is based on

a combination of formal asset and liability studies that include forward-looking return expectations given the current asset allocation.

The investment strategy underlying the asset allocation is to manage the assets of the U.S. plans to provide for the long-term

liabilities while maintaining sufficient liquidity to pay current benefits. This is primarily achieved by investing in equity-like investments

while investing a portion of the assets in long duration bonds in order to partially match the long-term nature of the liabilities. The

Plan undertakes an asset and liability modeling study once every three years or when there are material changes in the composition

of the plan liability or when market conditions change materially to reaffirm the current asset allocation and the related EROA

assumption. In early 2008, an asset and liability modeling study for the KRIP was completed and resulted in a 9% EROA

assumption. During the fourth quarter of 2008, the Kodak Retirement Income Plan Committee (“KRIPCO”, the committee that

oversees KRIP) reevaluated certain portfolio positions relative to current market conditions and accordingly approved a change to

the portfolio to reduce risk associated with volatility in the financial markets. It is KRIPCO’s intention to re-assess the current asset

allocation and complete a new asset and liability study in early 2009. The Company has assumed an 8% EROA for 2009 for the

KRIP based on its asset allocation at December 31, 2008.

The expected return on plan assets for the major non-U.S. pension plans range from 3.64% to 9.00% for 2008. Every three years or

when market conditions have changed materially, each of the Company’s larger pension plans will undertake asset allocation or

asset and liability modeling studies. It is anticipated that the Company’s larger plans will undertake new asset and liability modeling

studies in early 2009. The asset allocations and expected return on plan assets are individually set to provide for benefits included in

the projected benefit obligation within each country's legal investment constraints. The investment strategy is to manage the assets

of the non-U.S. plans to provide for the long-term liabilities while maintaining sufficient liquidity to pay current benefits. This is

primarily achieved by holding equity-like investments while investing a portion of the assets in long duration bonds in order to

partially match the long-term nature of the liabilities. Certain of the Company’s non-U.S. pension plans adjusted their target asset

positions during the fourth quarter of 2008. EROA assumptions for those plans were based on their respective asset allocations as of

the end of the year.