Kodak 2008 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

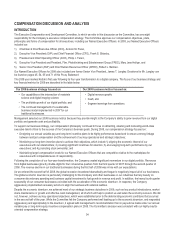

The Committee made the following decisions in 2008, which are described and referred within this Compensation Discussion and Analysis

as the “2008 Awards.”

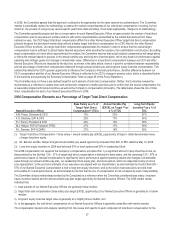

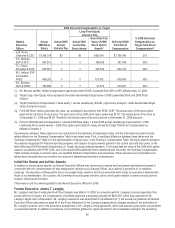

2008 Executive Compensation Determination Timeline

Committee Meeting

Compensation Determination

2008 Base salary considerations

February-08

2008 Annual variable pay plan (Executive Compensation for Excellence and Leadership: EXCEL) target

opportunity

Aggregate 2009 target dollar value, form and mix of long-term equity incentive awards

December 2008 stock option grant

January 2009 Leadership Stock allocation (Kodak's performance stock unit plan)

December-08

January 2009 restricted stock unit (RSU) grant

2008 Annual variable pay plan (EXCEL) award certification

January-09

2008 Leadership Stock certification

2009 Base salary considerations

February-09

2009 Annual variable pay plan (EXCEL) target opportunity

Decisions made by the Committee in 2007, which impacted 2008 compensation, were described in the Notice of 2008 Annual Meeting and

Proxy Statement.

Factors Considered by the Committee to Determine Level and Mix of Total Direct Compensation

The Committee considers a broad range of facts and circumstances when determining levels of executive compensation. Among the

factors that the Committee considers are: 1) market competitiveness; 2) experience relative to typical market peers; 3) the importance of

the position in the Company relative to other senior management positions; 4) sustained individual performance; 5) readiness for

promotion to a higher level and/or role in the Company’s senior management succession plans; and 6) retention of critical talent. The

significance of any individual factor will vary from year-to-year and may vary among Named Executive Officers.

The Committee establishes each Named Executive Officer’s level of annual target total direct compensation after reviewing market data

and factors listed in the prior paragraph. In general, the Committee does not consider awards granted or earned under plans in past years,

or the effect of changes in the Company’s stock price when setting annual target total direct compensation levels of our Named Executive

Officers. The Committee does, however, consider equity awards granted in past years in the evaluation of the retentive value of the

Company’s long-term equity incentive plans and the mix of long-term equity incentives as further described on page 42 of this Proxy

Statement. In addition, the Committee averaged the Company’s stock price over a 60-day period when converting the dollar-denominated

annual long-term incentive target opportunities into share equivalents as discussed on page 46 of this Proxy Statement.

Competitive Compensation Analysis

To assist the Committee in its annual market review of each Named Executive Officer’s total direct compensation, the Consultant prepares

an analysis of the market competitiveness of the aggregate value of total direct compensation as well as the market competitiveness of

each element of total direct compensation for each Named Executive Officer. The Consultant derives the market data from the average of

data from national surveys in which the Company participates.

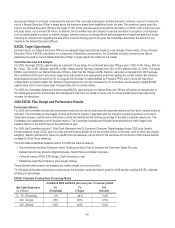

In 2008, market data was compiled from the Towers Perrin Executive Compensation Survey, the Hewitt Executive Compensation Survey

and the Radford Survey. These surveys are national non-industry specific compensation surveys. The data in each survey was size-

adjusted to be representative of companies with approximately $10.3 billion and $13.3 billion in revenue. The Committee reviewed this

competitive data for companies at both revenue levels to reflect the Company’s revenue size at the start of 2008 and its revenue size prior

to the divestiture of the Health Group on April 30, 2007. Given that the divestiture of the Health Group occurred in the prior year, the

Committee wanted visibility to the competitive target positioning at both revenue levels to ensure appropriate consideration for executives

who drove a divestiture decision in the best interest of shareholders. The number of companies included in the data with regard to each

survey is approximately 50.

The Committee does not review the individual companies who participate in these surveys. The Committee has used the national survey

data in lieu of a smaller group of specific companies to conduct a comparative analysis of total direct compensation because there were

few companies with a similar product portfolio, revenue and market capitalization size during the Company’s transformation and

emergence as a digital company. Based on the recommendation of its Consultant, the Committee believes these surveys provide a

reasonable representation of the cost to hire and retain executive talent.