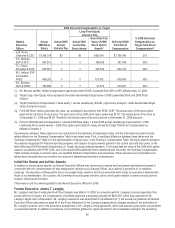

Kodak 2008 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

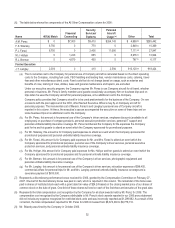

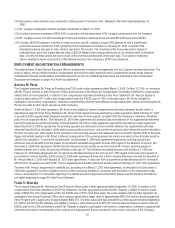

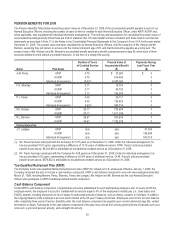

In addition, Mr. Sklarsky’s letter agreements provide that he is eligible to receive a supplemental retirement benefit, which is described

under the Pension Benefits Table on page 63 of this Proxy Statement.

The term of Mr. Sklarsky’s employment is indefinite but, according to his September 19, 2006 letter agreement, he will be eligible to

receive certain severance benefits in connection with termination of his employment under various circumstances. For information

regarding his potential severance payments and benefits, please read the narrative descriptions and tables beginning on page 69 of this

Proxy Statement.

Philip J. Faraci

The Company employed Mr. Faraci under a letter agreement dated November 3, 2004. In addition to the information provided elsewhere in

this Proxy Statement, Mr. Faraci initially received a base salary of $520,000 and a target award under the EXCEL plan of 62% of his base

salary. Mr. Faraci is eligible to participate in all incentive compensation, retirement, supplemental retirement and deferred compensation

plans, policies and arrangements that are provided to other senior executives of the Company. Mr. Faraci’s letter agreement also provides

him with a supplemental retirement benefit, as described on page 65 of this Proxy Statement.

Mr. Faraci’s letter agreement was amended by a letter agreement dated February 28, 2007 to provide for lump-sum payment of his

supplemental retirement benefits following the six-month anniversary of his termination.

In connection with his promotion to co-lead the Chief Operating Office with Mr. Langley in March 2007, Mr. Faraci’s base salary was

increased from $520,000 to $600,000 and his target EXCEL from 62% to 75% of his base salary. In September 2007, Mr. Faraci was

promoted to President and Chief Operating Officer and his base salary was increased to $700,000 and his target award under the EXCEL

plan was increased to 85% of his base salary.

The term of Mr. Faraci’s employment is indefinite but, according to his November 3, 2004 letter agreement, as amended by his December

9, 2008 letter agreement, he will be eligible for certain severance benefits in connection with termination of his employment under various

circumstances. For information regarding his potential severance payments and benefits in connection with termination of his employment

under various circumstances, please read the narrative descriptions and tables beginning on page 69 of this Proxy Statement.

Mary Jane Hellyar

The Company and Ms. Hellyar entered into a letter agreement dated August 18, 2006 to provide her with a restricted stock grant of 15,000

shares for retention purposes.

The term of Ms. Hellyar’s employment is indefinite but, according to her August 18, 2006 letter agreement, she will also be eligible for

certain severance benefits in connection with termination of her employment under various circumstances. For information regarding her

potential severance payments and benefits in connection with termination of her employment under various circumstances, please read

the narrative descriptions and tables beginning on page 69 of this Proxy Statement.

On October 16, 2007, Ms. Hellyar was granted 20,000 stock options upon her election to Executive Vice President. There was no other

change to her compensation associated with this election.

Robert L. Berman

Mr. Berman does not have a letter agreement concerning his employment or retention.

Former Executive: James T. Langley

Mr. Langley’s last day of employment with the Company was March 14, 2008. In connection with Mr. Langley’s planned separation from

service with the Company, Mr. Langley received certain severance payments and other benefits under the terms of his August 12, 2003

and February 28, 2007 letter agreements and the terms of his leaving arrangement approved by the Compensation Committee on

September 21, 2007. These payments and benefits are described on pages 65 and 71 of this Proxy Statement.