IHOP 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

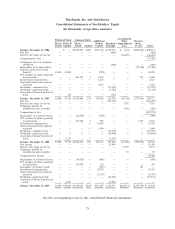

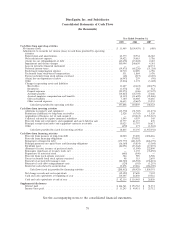

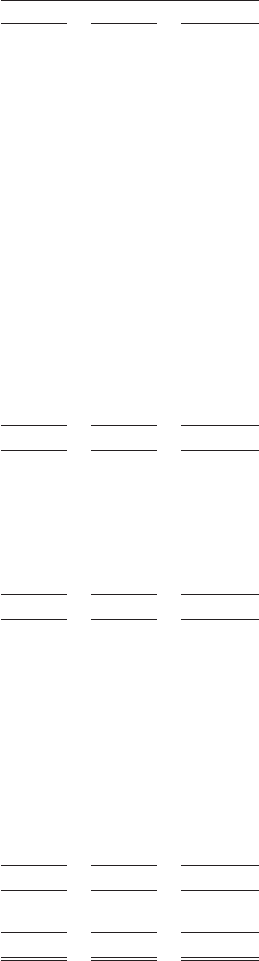

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

Year Ended December 31,

2009 2008 2007

Cash flows from operating activities

Net income (loss) ............................................ $ 31,409 $(154,459) $ (480)

Adjustments to reconcile net income (loss) to cash flows provided by operating

activities

Depreciation and amortization ................................... 65,379 72,934 26,043

Non-cash interest expense ...................................... 39,422 39,083 5,786

(Gain) loss on extinguishment of debt .............................. (45,678) (15,242) 2,223

Impairment and closure charges .................................. 105,094 240,630 4,381

Loss on derivative financial instrument ............................. — — 62,131

Deferred income taxes ........................................ (19,875) (65,226) (31,324)

Stock-based compensation expense ................................ 10,710 12,089 6,958

Tax benefit from stock-based compensation ........................... 531 1,864 3,476

Excess tax benefit from stock options exercised ........................ (48) (315) (2,693)

(Gain) loss on disposition of assets ................................ (6,947) 259 (98)

Other .................................................. (5,816) 1,172 (3,602)

Changes in operating assets and liabilities

Receivables ............................................. 11,607 (2,441) (22,479)

Inventories .............................................. (1,474) 182 512

Prepaid expenses .......................................... (25,273) (146) (17,147)

Accounts payable .......................................... (14,867) (23,749) 37,266

Accrued employee compensation and benefits ........................ (8,119) (11,609) (21,868)

Gift card liability .......................................... 7,180 18,480 43,685

Other accrued expenses ...................................... 14,613 (2,667) 13,553

Cash flows provided by operating activities ........................ 157,848 110,839 106,323

Cash flows from investing activities

Additions to property and equipment .............................. (15,372) (31,765) (11,871)

Reductions (additions) to long-term receivables ........................ 2,528 (4,743) 1,538

Acquisition of business, net of cash acquired .......................... — (10,261) (1,943,567)

Collateral released by captive insurance subsidiary ...................... 1,549 4,559 345

Proceeds from sale of property and equipment and assets held for sale ......... 15,777 61,137 870

Principal receipts from notes and equipment contracts receivable ............. 15,025 15,797 16,617

Other .................................................. (672) 471 (1,324)

Cash flows provided by (used in) investing activities .................. 18,835 35,195 (1,937,392)

Cash flows from financing activities

Proceeds from issuance of long-term debt ............................ 10,000 35,000 2,296,216

Proceeds from financing obligations ............................... — 370,502 —

Repayment of long-term debt ................................... (173,777) (421,325) (268,199)

Principal payments on capital lease and financing obligations ............... (16,160) (9,854) (5,364)

Dividends paid ............................................. (24,091) (33,362) (17,293)

(Payment of costs) issuance of preferred stock ......................... — (1,500) 222,800

Reissuance (purchase) of treasury stock, net .......................... — 1,135 (76,050)

Repurchase of restricted stock ................................... (605) (540) —

Proceeds from stock options exercised .............................. 324 989 8,928

Excess tax benefit from stock options exercised ........................ 48 315 2,693

Payment of accrued debt issuance costs ............................. (20,300) (48,902) (138,021)

Payment of early debt extinguishment costs ........................... (129) (103) (1,219)

Restricted cash related to securitization ............................. 15,878 49,216 (186,100)

Cash flows (used in) provided by financing activities .................. (208,812) (58,429) 1,838,391

Net change in cash and cash equivalents ............................ (32,129) 87,605 7,322

Cash and cash equivalents at beginning of year ........................ 114,443 26,838 19,516

Cash and cash equivalents at end of year ............................ $ 82,314 $ 114,443 $ 26,838

Supplemental disclosures

Interest paid .............................................. $166,361 $ 194,763 $ 31,331

Income taxes paid ........................................... $ 31,245 $ 40,931 $ 25,712

See the accompanying notes to the consolidated financial statements.

79