IHOP 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

4. Assets Held For Sale (Continued)

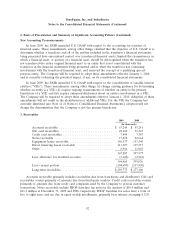

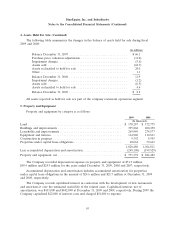

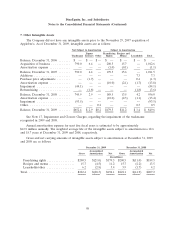

Property and equipment

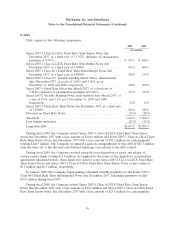

At December 31, 2007, assets held for sale primarily consisted of approximately 40 company-

operated Applebee’s restaurants in the California and Nevada markets, Applebee’s previous corporate

headquarters building, Applebee’s corporate aircraft and property and equipment from closed stores.

As the preliminary purchase price allocation was finalized during 2008, certain purchase price fair

values were revised downward and, as a result, assets held for sale were reduced by $11.0 million.

Additionally, an impairment was recognized on assets held for sale of $5.6 million due to deterioration

in the credit markets in general and a decline in operating results of Applebee’s company-operated

restaurants expected to be franchised in particular geographic areas. Also during 2008, four parcels of

land held for future restaurant development, three company-owned restaurants in the Delaware market,

49 company-operated restaurants in the Texas market and seven company-operated stores in the New

Mexico market were reclassified as assets held for sale. Additionally, one company-owned restaurant

was reclassified out of assets held for sale after a determination was made that the Company had

continuing involvement with the property which precluded classification as an asset held for sale.

The sales of the restaurants in the California, Nevada, Delaware and Texas markets, along with

one closed store site were completed in 2008. The Company received proceeds of approximately

$49.4 million from these transactions. At December 31, 2008, assets held for sale comprised primarily

seven company-operated restaurants in New Mexico and four parcels of land held for future restaurant

development and property and equipment from closed stores.

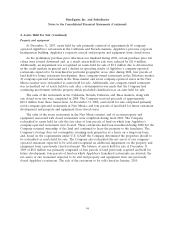

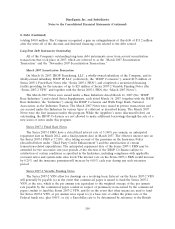

The sales of the seven restaurants in the New Mexico market and of certain property and

equipment associated with closed restaurants were completed during fiscal 2009. The Company

reclassified to assets held for sale the fair value of four parcels of land on which four Applebee’s

company-operated restaurants were located. These restaurants had been franchised during 2008 but the

Company retained ownership of the land and continued to lease the property to the franchisee. The

Company’s strategy does not contemplate retaining such properties as a lessor on a long-term basis,

and, based on the requirements under U.S. GAAP, the Company determined the properties should to

be reclassified as assets held for sale. The Company also reclassified the net assets of one company-

operated restaurant expected to be sold and recognized an additional impairment on the property and

equipment from a previously closed restaurant The balance of assets held for sale at December 31,

2009 of $8.8 million was primarily comprised of four parcels of land previously acquired and held for

future development, four parcels of land on which Applebee’s franchised restaurants are situated, the

net assets of one restaurant expected to be sold and property and equipment from one previously

closed Applebee’s restaurant. The sale of the restaurant to be sold closed in January, 2010.

94