IHOP 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

New Accounting Pronouncements

In June 2009, the FASB amended U.S. GAAP with respect to the accounting for transfers of

financial assets. These amendments, among other things, clarified that the objective of U.S. GAAP is to

determine whether a transferor and all of the entities included in the transferor’s financial statements

being presented have surrendered control over transferred financial assets; limited the circumstances in

which a financial asset, or portion of a financial asset, should be derecognized when the transferor has

not transferred the entire original financial asset to an entity that is not consolidated with the

transferor in the financial statements being presented and/or when the transferor has continuing

involvement with the transferred financial asset; and removed the concept of a qualifying special-

purpose entity. The Company will be required to adopt these amendments effective January 1, 2010,

and is currently evaluating the potential impact, if any, on its consolidated financial statements.

In June 2009, the FASB amended U.S. GAAP with respect to the consolidation of variable interest

entities (‘‘VIEs’’). These amendments, among other things, (i) change existing guidance for determining

whether an entity is a VIE; (ii) require ongoing reassessments of whether an entity is the primary

beneficiary of a VIE; and (iii) require enhanced disclosures about an entity’s involvement in a VIE.

The Company will be required to adopt these amendments effective January 1, 2010. Adoption of these

amendments will not result in the identification of additional VIEs. For the VIE the Company has

currently identified (see Note 14 of Notes to Consolidated Financial Statements), adoption will not

change the determination that the Company is not the primary beneficiary.

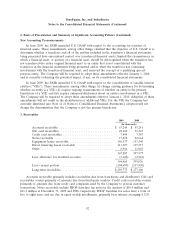

3. Receivables

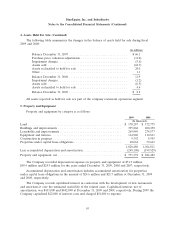

2009 2008

(In thousands)

Accounts receivable .............................. $ 53,245 $ 55,241

Gift card receivables .............................. 22,660 32,345

Credit card receivables ............................ 7,494 7,587

Notes receivable ................................. 17,678 22,664

Equipment leases receivable ........................ 146,537 153,560

Direct financing leases receivable .................... 111,307 115,517

Other ........................................ 8,966 11,063

367,887 397,977

Less: allowance for doubtful accounts ................. (3,422) (2,941)

364,465 395,036

Less: current portion ............................. (104,690) (117,930)

Long-term receivables ............................. $259,775 $ 277,106

Accounts receivable primarily includes receivables due from franchisees and distributors. Gift card

receivables consist primarily of amounts due from third-party vendors. Credit card receivables consist

primarily of amounts due from credit card companies used by the Company to process customer

transactions. Notes receivable include IHOP franchise fee notes in the amount of $10.4 million and

$16.1 million at December 31, 2009 and 2008, respectively. IHOP franchise fee notes have a term of

five to eight years and are due in equal weekly installments, primarily bear interest averaging 8.32%

92