IHOP 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• reduced cash flows from franchisees due to both a lower sales base on which royalties and other

payments are calculated and possible impairment of the ability of franchisees to make payments

when due as a result of the economic effects cited above on their businesses;

• reduced availability of financing for franchisees to fulfill their new restaurant development

commitments;

• limited or lack of credit availability for potential purchasers of Applebee’s company-operated

restaurants;

• lower proceeds from the franchising of Applebee’s company-operated restaurants due to both

lower restaurant sales and profitability and/or inability to consummate transactions at all; and

• lower estimated fair values for goodwill, intangible assets and long-lived assets resulting in future

non-cash impairment charges.

We cannot predict the effect or duration of this economic slowdown or the timing and strength of

a subsequent recovery in the economy in general or the restaurant industry in particular. If our

business significantly deteriorates due to these macroeconomic effects, our financial condition and

results of operations will likely be materially and adversely affected.

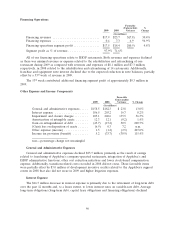

Fifty-Three Week Fiscal Year

Our fiscal year ends on the Sunday nearest to December 31 of each year. As a result, every five or

six years our fiscal year contains 53 calendar weeks. Fiscal 2009 contained 53 weeks whereas fiscal 2008

and 2007 each contained 52 weeks. The estimated impact of the 53rd week in fiscal 2009 in comparison

to fiscal 2008 was an increase in revenue of $29.2 million, an increase in segment profit of $13.5 million

and an increase in income before income taxes of $10.9 million. While certain expenses increased in

direct relationship to additional revenue from the 53rd week, other costs (for example, depreciation

and other fixed costs) are incurred on a calendar month basis. Therefore, the impact of the additional

week is not necessarily indicative of a typical relationship of expenses to revenues measured over a

longer period of comparison, such as a fiscal month or a fiscal quarter.

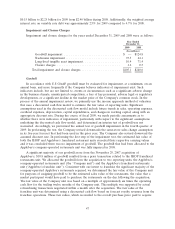

Securitized Debt and Related Interest Expense

Certain of our subsidiaries incurred a substantial amount of indebtedness to finance the

Applebee’s acquisition. Because of early retirement of debt and a decline in variable interest rates, our

interest expense decreased $16.7 million from the prior year. While it is not likely interest rates on our

variable-rate debt will continue to decline significantly below current levels and may, in fact, increase in

the future, we will amortize debt in the normal course of business and we intend to use excess

operating cash flow to repurchase debt when the opportunity is available. As a result we expect our

total interest expense will decline. We estimate our interest expense for fiscal 2010 will range from

$175 million to $180 million, which includes $40 million of non-cash interest charges. However, interest

expense is expected to remain as one of the largest components of costs and expenses in the future

until such time that debt balances are repaid.

37