IHOP 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

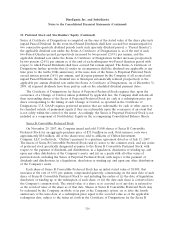

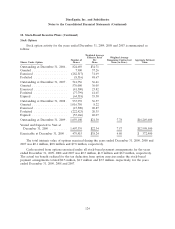

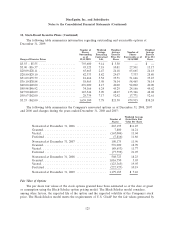

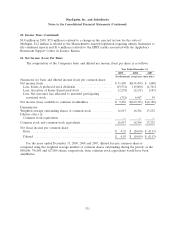

18. Stock-Based Incentive Plans (Continued)

the model may not be indicative of the actual fair values of the Company’s stock-based awards. The

following table summarizes the assumptions used to value options granted in the respective periods:

2009 2008 2007

Risk free interest rate ........................ 1.95% 2.83% 4.39%

Weighted average historical volatility .............. 72.3% 77.9% 24.9%

Dividend yield .............................. — 3.09% 1.75%

Expected years until exercise ................... 5 Years 5 Years 5 Years

Forfeitures ................................ 11.0% 7.02% 6.72%

Weighted average fair value of options granted ...... $ 5.03 $ 18.70 $ 14.21

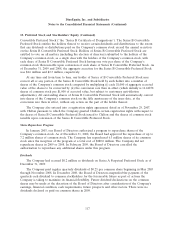

Restricted Stock

Restricted stock activity for the years ended December 31, 2009, 2008 and 2007 is set forth below:

Weighted Average

Number of Grant-Date Per Share

Shares Fair Value

Unvested at December 31, 2006 ................ 168,100 $50.31

Granted ................................. 277,190 54.72

Forfeited ................................. (10,000) 52.96

Unvested at December 31, 2007 ................ 435,290 53.04

Granted ................................. 399,785 38.75

Released ................................. (72,520) 55.89

Forfeited ................................. (91,075) 46.19

Unvested at December 31, 2008 ................ 671,480 45.07

Granted ................................. 241,125 10.92

Released ................................. (139,649) 51.40

Forfeited ................................. (122,633) 34.23

Unvested at December 31, 2009 ................ 650,323 $33.09

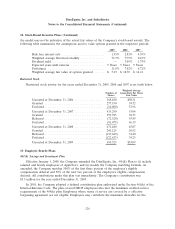

19. Employee Benefit Plans

401(k) Savings and Investment Plan

Effective January 1, 2009, the Company amended the DineEquity, Inc. 401(k) Plan to (i) include

salaried and hourly employees of Applebee’s, and (ii) modify the Company matching formula. As

amended, the Company matches 100% of the first three percent of the employee’s eligible

compensation deferral and 50% of the next two percent of the employee’s eligible compensation

deferral. All contributions under this plan vest immediately. The Company’s contribution was

$3.5 million for the year ended December 31, 2009.

In 2001, the Company adopted a defined contribution plan authorized under Section 401(k) of the

Internal Revenue Code. The plan covered IHOP employees who met the minimum credited service

requirements of the 409(k) plan. Employees whose terms of service are covered by a collective

bargaining agreement are not eligible. Employees may contribute the maximum allowable for the

126