IHOP 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.revenues generated by company-owned restaurants and the franchise payments received from

franchisees.

Our business strategy may not achieve the anticipated results. We expect to continue to apply a new

business strategy that includes, among other things, (i) the franchising of more than 90% of the

Applebee’s company-operated restaurants, (ii) specific changes in the manner in which our Applebee’s

and IHOP businesses are managed and serviced, such as the February 2009 establishment of a

purchasing cooperative, and the procurement of products and services from such purchasing

cooperative, (iii) the possible introduction of new restaurant concepts and (iv) more generally,

improvements to the overall performance of the Applebee’s business by applying some of the strategies

we previously applied to the IHOP restaurant business. However, the Applebee’s business is different

in many respects from the IHOP business. In particular, the Applebee’s restaurants are part of the

casual dining segment of the restaurant industry whereas the IHOP restaurants are part of the family

dining segment, and the Applebee’s business is larger, distributed differently across the United States

and appeals to a somewhat different segment of the consumer market. Therefore, there can be no

assurance that the business strategy we apply to the Applebee’s business will be suitable or will achieve

similar results to the application of such business strategy to the IHOP system. In particular, the

franchising of Applebee’s company-operated restaurants may not improve the performance of such

restaurants and may not reduce the capital expenditures to the extent we anticipate or result in the

other intended benefits of the strategy. The actual benefit from the franchising of the Applebee’s

company-operated restaurants is uncertain and may be less than anticipated.

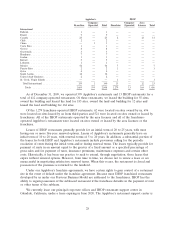

As of December 31, 2009 we have franchised 110 of the Applebee’s company-operated restaurants

acquired on November 29, 2007. There can be no assurance that we will be able to complete the

refranchising of a substantial majority of the remaining 399 company-operated restaurants on desirable

terms or within the anticipated time frame. The anticipated proceeds from the refranchising of the

company-operated restaurants are based on current market values, recent comparable transaction

valuations, and a number of other assumptions. The franchising of Applebee’s company-operated

restaurants is not expected to be completed for several years. If market rents, comparable transaction

valuations or other assumptions prove to be incorrect, the actual proceeds from the franchising of the

company-operated restaurants may be different than anticipated. In addition, adverse economic, market

or other conditions existing in the states in which company-operated real property is located may

adversely affect our ability to execute the franchising transactions or to achieve the anticipated returns

from such transactions. Market conditions may have changed at the time the franchising transactions

occur. Finally, the operational improvement initiatives or purchasing initiatives may not be successful or

achieve the desired results. In particular, there can be no assurance that the existing franchisees or

prospective new franchisees will respond favorably to such initiatives.

Factors specific to the restaurant industry, some of which are outside of our control, may have a material

adverse effect on our business. The sales and profitability of our restaurants and, in turn, payments from

our franchisees may be negatively impacted by a number of factors, some of which are outside of our

control. The most significant are:

• declines in comparable store sales growth rates due to: (i) failing to meet customers’

expectations for food quality and taste or to innovate new menu items to retain the existing

customer base and attract new customers; (ii) competitive intrusions in our markets;

(iii) opening new restaurants that cannibalize the sales of existing restaurants; (iv) failure of

national or local marketing to be effective; (v) weakening national, regional and local economic

conditions; and (vi) natural disasters or extreme weather conditions.

• negative trends in operating expenses such as: (i) increases in food costs including rising

commodity costs; (ii) increases in labor costs including increases mandated by minimum wage

and other employment laws, immigration reform, the potential impact of union organizing

19