IHOP 2009 Annual Report Download - page 106

Download and view the complete annual report

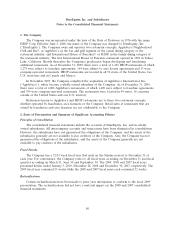

Please find page 106 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

financial statements as company restaurant expenses. At both December 31, 2009 and 2008, the liability

recorded for asset retirement obligations was $0.3 million.

Derivative Financial Instruments

The Company accounts for derivative instruments and hedging activities in accordance with

U.S. GAAP. All derivatives are recognized on the balance sheet at their fair value. On the date that the

Company enters into a derivative contract, management formally documents all relationships between

hedging instruments and hedged items, as well as risk management objectives and strategies for

undertaking various hedge transactions.

Changes in the fair value of a derivative that is highly effective and that is designated and qualifies

as a cash flow hedge (a ‘‘swap’’), to the extent that the hedge is effective, are recorded in accumulated

other comprehensive income, until earnings are affected by the variability of cash flows of the hedged

transaction. The Company measures effectiveness of the swap at each quarter end, using the

hypothetical derivative method. Under this method, hedge effectiveness is measured based on a

comparison of the change in fair value of the actual swap designated as the hedging instrument and the

change in fair value of the hypothetical swap which would have the terms that identically match the

critical terms of the hedged cash flows from the anticipated debt issuance. The amount of

ineffectiveness, if any, recorded in earnings would be equal to the excess of the cumulative change in

the fair value of the swap over the cumulative change in the fair value of the plain vanilla swap lock, as

defined in the accounting literature. Once a swap is settled, the effective portion is amortized over the

estimated life of the hedged item.

In the past, the Company has utilized derivative financial instruments to manage its exposure to

interest rate risks. The Company has not entered into any derivative financial instruments since an

interest rate swap entered into in conjunction with the acquisition of Applebee’s was terminated in

2007 (See Note 8, Debt). The Company does not enter into derivative financial instruments for trading

purposes.

Fair Value Measurements

Effective January 1, 2008, the Company determines the fair market values of its financial assets

and liabilities, as well as non-financial assets and liabilities that are recognized or disclosed at fair value

on a recurring basis, based on the fair value hierarchy established in U.S. GAAP. The Company

measures its financial assets and liabilities using inputs from the following three levels of the fair value

hierarchy. The three levels are as follows:

• Level 1 inputs are unadjusted quoted prices in active markets for identical assets or liabilities

that the Company has the ability to access at the measurement date.

• Level 2 inputs include quoted prices for similar assets and liabilities in active markets, quoted

prices for identical or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable for the asset or liability (i.e., interest rates, yield curves, etc.),

and inputs that are derived principally from or corroborated by observable market data by

correlation or other means (market corroborated inputs).

• Level 3 includes unobservable inputs that reflect our assumptions about the assumptions that

market participants would use in pricing the asset or liability. The Company develops these

inputs based on the best information available, including our own data.

87