IHOP 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

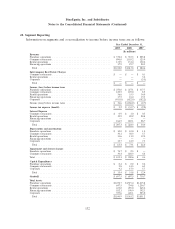

17. Impairments and Closure Charges (Continued)

Impairment and closure charges in 2007 included the impairment of long lived assets for three

restaurants closed in 2007, and impairment losses on two restaurants in which the reacquisition values

exceeded the historical resale values. The decision to close or impair the restaurants in 2007 was a

result of a comprehensive analysis that examined restaurants not meeting minimum return on

investment thresholds and certain other operating performance criteria. The assets for these restaurants

were written down to their estimated fair value.

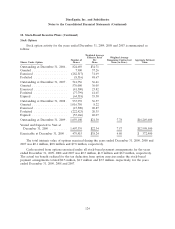

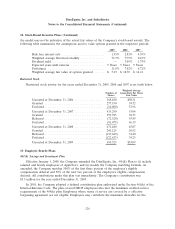

18. Stock-Based Incentive Plans

General Description

The Stock Incentive Plan (the ‘‘1991 Plan’’) was adopted in 1991 and amended and restated in

1998 to authorize the issuance of up to 3,760,000 shares of common stock pursuant to options,

restricted stock, and other long-term stock-based incentives to officers and key employees of the

Company. The 2001 Stock Incentive Plan (the ‘‘2001 Plan,’’ together with the 1991 Plan, the ‘‘Plans’’)

was adopted in 2001 and amended and restated in 2005 and 2008 to authorize the issuance of up to

4,200,000 shares of common stock. No option can be granted at an option price of less than the fair

market value at the date of grant as defined in both Plans. Exercisability of options is determined at, or

after, the date of grant by the administrator of both Plans. All options granted under both Plans

through December 31, 2009, become exercisable one-third after one year, two-thirds after two years

and 100% after three years or immediately upon a change in control of the Company, as defined in

both Plans.

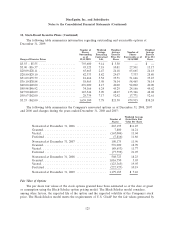

The Stock Option Plan for Non-Employee Directors (the ‘‘Directors Plan’’) was adopted in 1994

and amended and restated in 1999 to authorize the issuance of up to 400,000 shares of common stock

pursuant to options to non-employee members of the Company’s Board of Directors. Options were to

be granted at an option price equal to 100% of the fair market value of the stock on the date of grant.

Options granted pursuant to the Directors Plan vest and became exercisable one-third after one year,

two-thirds after two years and 100% after three years or immediately upon a change in control of the

Company, as defined in the Directors Plan. Options for the purchase of shares were granted to each

non-employee Director under the Directors Plan as follows: (1) an option to purchase 15,000 shares on

February 23, 1995, or on the Director’s election to the Board of Directors if he or she was not a

Director on such date, and (2) an option to purchase 5,000 shares annually in conjunction with the

Company’s Annual Meeting of Stockholders for that year.

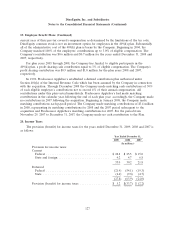

The 2005 Stock Incentive Plan for Non-Employee Directors (the ‘‘2005 Plan’’) was adopted in 2005

to authorize the issuance of up to 200,000 shares of common stock to non-employee members of the

Company’s Board of Directors. Awards may be made in common stock, in options to purchase common

stock, or in shares of common stock subject to certain restrictions (‘‘Restricted Stock’’), or any

combination thereof. The terms and conditions of awards granted are established by the Compensation

Committee of the Company’s Board of Directors, but become immediately vested upon a change in

control of the Company, as defined in the 2005 Plan. Options are to be granted at an option price not

less than 100% of the fair market value of the stock on the date of grant. The 2005 Plan provides for

an initial grant of Restricted Stock (‘‘Initial Grant’’). At the end of a specified performance period, the

number of shares in the Initial Grant will be increased or decreased, based on the percentage increase

or decrease in the fair market value of the Company’s common stock during the performance period.

122