IHOP 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

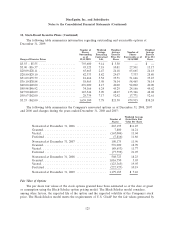

14. Consolidation of Variable Interest Entities (Continued)

The Co-op does not purchase items on behalf of member restaurants; rather, it facilitates

purchasing agreements and distribution arrangements between suppliers and member restaurants. Each

member restaurant is responsible for only the goods and services it chooses to purchase and bears no

responsibility or risk of loss for goods and services purchased by other member restaurants. Further,

the Company bears no responsibility or risk of loss for goods and services purchased franchise

restaurants deemed de facto agents for purposes of determining the primary beneficiary of the VIE.

Based on these facts, the Company believes its maximum estimated loss related to its membership in

the Co-op is de minimis.

The Company does not anticipate that the adoption on January 1, 2010 of new U.S. GAAP

requirements with respect to VIEs will affect the determination of the primary beneficiary of the Co-op

(see Note 2, Basis of Presentation and Summary of Significant Accounting Policies).

15. Preferred Stock and Stockholders’ Equity

Preferred Stock

As part of the financing for the Applebee’s acquisition, on November 29, 2007, the Company

completed two separate private placements of preferred stock.

Series A Perpetual Preferred Stock

On November 29, 2007, the Company issued and sold 190,000 shares of Series A Perpetual

Preferred Stock (the ‘‘Series A Perpetual Preferred Stock’’) for an aggregate purchase price of

$190.0 million in cash. Total issuance costs were approximately $3.0 million. All of the shares were sold

to MSD SBI, L.P., an affiliate of MSD Capital, L.P., pursuant to a purchase agreement dated as of

July 15, 2007, as amended as of November 29, 2007. The shares of Series A Perpetual Preferred Stock

rank (i) senior to the common stock, and any series of preferred stock specifically designated as junior

to the Series A Perpetual Preferred Stock, with respect to the payment of dividends and distributions,

in a liquidation, dissolution or winding up, and upon any other distribution of the Company’s assets;

and (ii) on a parity with all other series of preferred stock, including the Series B Convertible Preferred

Stock, described below, with respect to the payment of dividends and distributions, in a liquidation,

dissolution or winding up, and upon any other distribution of the Company’s assets.

The holders of the Series A Perpetual Preferred Stock are entitled to receive dividends, at the

rates and on the dates set forth in the Certificate of Designations for the Series A Perpetual Preferred

Stock (the ‘‘Series A Certificate of Designations’’), if, as, and when such dividends are declared by the

Company’s Board of Directors, but out of funds legally available for the payment of dividends, which

dividends are payable in cash, subject to the Company’s right to elect to accumulate any dividends

payable after the first anniversary of the issue date. If, on any scheduled dividend payment date, the

holder of record of a share of Series A Perpetual Preferred Stock does not receive in cash the full

amount of any dividend required to be paid on such share on such date pursuant to the Series A

Certificate of Designations (such unpaid dividends that have accrued and were required to be paid, but

remain unpaid, on a scheduled dividend payment date, together with any accrued and unpaid

accumulated dividends, the ‘‘Passed Dividends’’), then such Passed Dividends accumulate on such

outstanding share of Series A Perpetual Preferred Stock, whether or not there are funds legally

available for the payment thereof or such Passed Dividends are declared by the Company’s Board of

Directors, and until such Passed Dividends have been paid, the applicable dividend rate under the

115