IHOP 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

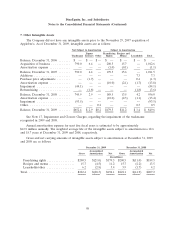

Notes to the Consolidated Financial Statements (Continued)

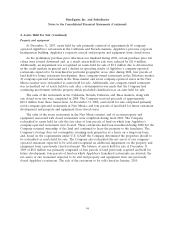

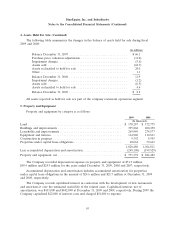

8. Debt (Continued)

Applebee’s Securitization

On November 29, 2007, Applebee’s Enterprises LLC, Applebee’s IP LLC and other wholly-owned

subsidiaries of Applebee’s (collectively, the ‘‘Applebee’s Co-Issuers), completed a $1.794 billion

securitization transaction as described below. All of the notes issued in the Applebee’s securitization

were issued pursuant to an indenture (the ‘‘Applebee’s Base Indenture’’), and entered into by and

among the Applebee’s Co-Issuers and Wells Fargo Bank, and the related Series 2007-1 Supplement,

each dated as of November 29, 2007 (together with the Applebee’s Base Indenture, the ‘‘Applebee’s

Indenture’’).

Fixed Rate Notes

The Applebee’s securitization consists of the following four classes of fixed rate notes (the

‘‘Applebee’s November 2007-1 Notes’’):

• $350 million of Series 2007-1 Class A-2-I-X Fixed Rate Term Senior Notes, which do not have

the benefit of a financial guaranty insurance policy. These notes had an expected life of

approximately six months, with a legal maturity of 30 years. The Class A-2-I-X Fixed Rate Term

Senior Notes were repaid in July 2008.

• $675 million of Series 2007-1 Class A-2-II-A Fixed Rate Term Senior Notes that have the benefit

of a financial guaranty insurance policy covering payment of interest when due and payment of

principal at the applicable legal final maturity date. These notes have an expected life of

approximately five years, with a legal maturity of 30 years.

• $650 million of Series 2007-1 Class A-2-II-X Fixed Rate Term Senior Notes, which do not have

the benefit of a financial guaranty insurance policy. These notes have an expected life of

approximately five years, with a legal maturity of 30 years.

• $119 million of Series 2007-1 Class M-1 Fixed Rate Term Subordinated Notes, which do not

have the benefit of a financial guaranty insurance policy. These notes have an expected life of

approximately four years, with a legal maturity of 30 years.

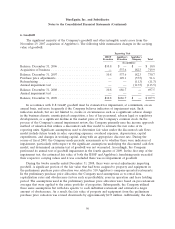

The Applebee’s Indenture includes provisions which accelerate certain of the payment dates which,

if not met, would require the Company to use operating funds to begin to pay down the outstanding

debt. The accelerated payment date for the Applebee’s November 2007-1 Notes will occur in December

2012, unless accelerated by failure to comply with provisions of the Applebee’s Indenture. As of

December 31, 2009, there was no acceleration of payment dates.

In the event that the Company is unable to refinance the Applebee’s securitization debt by

December 2012, then the Company will have the ability to extend the scheduled payment date for six

months if in compliance with applicable covenant ratios at that time and, under certain circumstances,

if consent is obtained from the series controlling party. Upon an extension, the interest rate on the

Applebee’s securitization debt will increase by 0.50%, and any unpaid amount will accrue interest at

such increased rate and the insurance premium will increase by 0.1%.

In the event that the Company is unable to refinance the Applebee’s securitization debt by

December 2012, or, if an extension has been obtained and the Company is unable to refinance the

Applebee’s securitization debt by June 2013, the debt will go into rapid amortization and all excess cash

103