IHOP 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

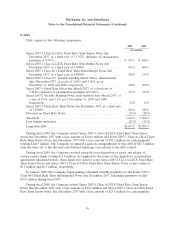

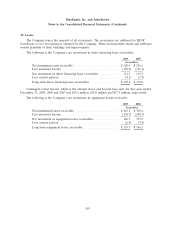

8. Debt (Continued)

totaling $40.0 million. The Company recognized a gain on extinguishment of this debt of $15.2 million

after the write-off of the discount and deferred financing costs related to the debt retired.

Long-Term Debt Instruments Outstanding

All of the Company’s outstanding long-term debt instruments arose from several securitization

transactions that took place in 2007, which are referred to as the ‘‘March 2007 Securitization

Transaction’’ and the ‘‘November 2007 Securitization Transactions.’’

March 2007 Securitization Transaction

On March 16, 2007, IHOP Franchising, LLC, a wholly-owned subsidiary of the Company, and its

wholly-owned subsidiary, IHOP IP, LLC (collectively, the ‘‘IHOP Co-Issuers’’), issued $175 million of

Series 2007-1 Fixed Rate Notes (the ‘‘Series 2007-1 FRN’’) and completed a securitized financing

facility providing for the issuance of up to $25 million of Series 2007-2 Variable Funding Notes (the

‘‘Series 2007-2 VFN’’ and together with the Series 2007-1 FRN, the ‘‘March 2007 Notes’’).

The March 2007 Notes were issued under a Base Indenture dated March 16, 2007 (the ‘‘IHOP

Base Indenture’’) and related Series Supplements, each dated March 16, 2007 (together with the IHOP

Base Indenture, the ‘‘Indenture’’) among the IHOP Co-Issuers and Wells Fargo Bank, National

Association, as the Indenture Trustee. The March 2007 Notes were issued in private transactions and

are secured under the Indenture by various types of collateral as described herein. The March 2007

Notes were the first issuances under this program. While the Applebee’s notes (discussed below) are

outstanding, the IHOP Co-Issuers are not allowed to make additional borrowings through the sale of a

new series of notes under this program.

Series 2007-1 Fixed Rate Notes

The Series 2007-1 FRN have a stated fixed interest rate of 5.144% per annum, an anticipated

repayment date in March 2012, and a final payment date in March 2037. The effective interest rate on

the Series 2007-1 FRN is 7.218%, after taking account of the premium on the Insurance Policy

(described below under ‘‘Third Party Credit Enhancement’’) and the amortization of certain

transaction-related expenditures. The anticipated repayment date of the Series 2007-1 FRN may be

extended for two successive one-year periods at the election of the IHOP Co-Issuers subject to

satisfaction of certain conditions as specified in the Indenture, including compliance with applicable

covenant ratios and system-wide sales levels The interest rate on the Series 2007-1 FRN would increase

by 0.25% and the insurance premium will increase by 0.05% each year during any such extension

period.

Series 2007-2 Variable Funding Notes

The Series 2007-2 VFN allow for drawings on a revolving basis. Interest on the Series 2007-2 VFN

will generally be payable (a) in the event that commercial paper is issued to fund the Series 2007-2

VFN, at the rate, which is the per annum rate equivalent to the weighted average of the per annum

rate payable by the commercial paper conduit in respect of promissory notes issued by the commercial

paper conduit to fund the Series 2007-2 VFN, and (b) in the event that other means are used to fund

the Series 2007-2 VFN, at per annum rates equal to (i) a base rate of either the prime rate or the

Federal funds rate, plus 0.40%, or (ii) a Eurodollar rate to be determined by reference to the British

100