IHOP 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

IHOP

The franchise operations segment consists of restaurants operated by IHOP franchisees and area

licensees in the United States, two U.S. territories and two countries outside the U.S. Franchise

operations revenue consists primarily of franchise royalty revenues, sales of proprietary products,

franchise advertising fees and the portion of the franchise fees allocated to IHOP intellectual property.

Franchise operations expenses include advertising expense, the cost of proprietary products and

pre-opening training expenses and other franchise-related costs.

The company restaurant operations segment consists of company-operated restaurants in the

United States. In addition, from time to time, restaurants that are reacquired from franchisees are

operated by IHOP on a temporary basis. Company restaurant sales are retail sales at company-

operated restaurants. Company restaurant expenses are operating expenses at company-operated

restaurants and include food, labor, benefits, utilities, rent and other restaurant operating costs.

Rental operations revenue includes revenue from operating leases and interest income from direct

financing leases. Rental operations expenses are costs of operating leases and interest expense on

capital leases on franchisee-operated restaurants.

Financing operations revenue consists of the portion of franchise fees not allocated to IHOP

intellectual property, sales of equipment, as well as interest income from the financing of franchise fees

and equipment leases. Financing expenses are primarily the cost of restaurant equipment.

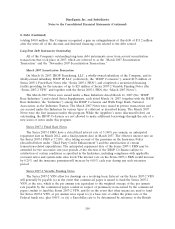

Recently Adopted Accounting Standards

In September 2006, the Financial Accounting Standards Board (the ‘‘FASB’’) amended U.S. GAAP

with respect to fair value measurements. These amendments, among other things, defined ‘‘fair value,’’

established a framework for measuring fair value and expanded disclosures about fair value

measurements. In February 2008, the FASB delayed for one year the applicability of the amended

fair-value measurement requirements to certain nonfinancial assets and liabilities. The Company

adopted the requirements that had been deferred on January 1, 2009. The adoption did not have a

material impact on the Company’s consolidated financial statements.

In December 2007, the FASB amended U.S. GAAP with respect to business combinations. These

amendments, among other things, established principles and requirements for how an acquirer

recognizes and measures in its financial statements the identifiable assets acquired, the liabilities

assumed, any noncontrolling interest in the acquiree and the goodwill acquired. These amendments

also established disclosure requirements to enable the evaluation of the nature and financial effects of

the business combination. The amendments are effective for fiscal years beginning after December 15,

2008. The Company adopted the amended requirements for business combinations on January 1, 2009

and will apply the requirements prospectively.

In March 2008, the FASB amended U.S. GAAP with respect to derivative instruments and hedging

activities. These amendments, among other things, require companies to provide enhanced disclosures

about (a) how and why they use derivative instruments, (b) how derivative instruments and related

hedged items are accounted for, and (c) how derivative instruments and related hedged items affect a

company’s financial position, financial performance and cash flows. The Company adopted the new

disclosure requirements on January 1, 2009. As the amendments did not change current accounting

practice, there was no impact of the adoption on the Company’s consolidated financial statements.

90