IHOP 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for six months if we are in compliance with applicable covenant ratios at that time. The interest rate on

this debt will increase by 0.50%, and any unpaid amount will accrue interest at such increased rate.

Similarly, if we are unable to refinance the IHOP March 2007 securitization debt by March 2012,

we will have the ability to extend the scheduled repayment date for up to two years with a 0.25%

annual increase in the interest rate each year. However, if the IHOP November 2007 securitization

debt goes into rapid amortization, the IHOP March 2007 securitization debt will go into rapid

amortization as well.

We intend to refinance all of the Applebee’s and IHOP indebtedness prior to the expiration of

such extension periods that are available. We may also seek to renegotiate the terms applicable to the

repayment of principal under the relevant securitization program, raise capital or otherwise explore

alternative measures to repay the securitization debt. In the event that we are unable to refinance the

Applebee’s or IHOP securitization debt upon the expiration of the relevant extension periods, a Rapid

Amortization Event (see ‘‘Debt Covenant Compliance’’ below) will occur under the applicable

securitization program and all excess cash flow (after all required payments have been made) will be

deposited in the principal payment account for that program and used to repay principal of the

applicable securitization debt.

Currently, there is no specific plan to prepay any of the securitization debt prior to

December 2012. However, we are constantly reviewing all available options to efficiently manage our

debt portfolio in light of the general economic climate and market conditions. In the event a significant

portion of the securitization debt is repaid prior to December 2012, we may be liable for certain

make-whole prepayment penalties with respect to the securitization debt and the applicable insurance

policies. The amount of any prepayment penalty with respect to the securitization debt would be

determined based upon, among other things, the date of repayment, prevailing benchmark interest rates

at the time of repayment and the percentage of debt repaid. Although generally speaking the amount

of penalty will decline to zero in December 2012, the decline is not necessarily linear over time due to

specific provisions under the indenture under which the debt was issued and the variability of interest

rates. Detailed calculations of prepayment penalties are contained in the applicable series supplements

filed as Exhibits 4.6 and 4.7 to our Form 10-Q filed on May 9, 2007 and Exhibits 4.20 and 4.22 to our

Form 10-K filed on February 28, 2008. The prepayment penalty does not apply to open-market

repurchases of the debt.

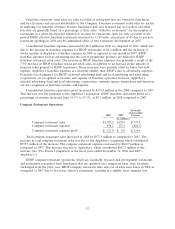

Debt Covenant Compliance

As part of the financing for the Applebee’s acquisition, certain subsidiaries of the Company

completed two separate securitization transactions. The securitization transactions consisted of an

issuance of debt collateralized by Applebee’s restaurant assets (the ‘‘Applebee’s Notes’’) and a separate

issuance of debt collateralized by IHOP restaurant assets (the ‘‘IHOP Notes’’). Previously, IHOP

completed a $200 million securitization in March 2007, which is subject to the same debt covenants as

IHOP’s November 2007 securitization. This securitized debt is subject to a series of covenants and

restrictions which are customary for transactions of this type. As of December 31, 2009, approximately

$1.7 billion of securitized debt is subject to these covenants and restrictions.

The most significant covenants related to the securitized debt require the maintenance of a

consolidated leverage ratio and certain debt service coverage ratios. The consolidated leverage ratio is

defined as (a) the sum of: (i) all securitized debt (assuming all variable funding facilities are fully

drawn); (ii) all other debt of the Company; and (iii) current monthly operating lease expense multiplied

60