IHOP 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investment thresholds and certain other operating performance criteria. The assets for these restaurants

were written down to their estimated fair value.

Amortization of Intangible Assets

Amortization of intangible assets was $12.1 million and $1.1 million for the years ended

December 31, 2008 and 2007, respectively. The increase was due to the inclusion of twelve months of

amortization in 2008 as compared to one month in 2007. The amortization relates to intangible assets

with finite lives, primarily franchising rights, recorded as part the allocation of the Applebee’s purchase

price.

(Gain) Loss on Extinguishment of Debt

In August 2008, the Company retired certain Series 2007-1 Class A-2-II-A Fixed Rate Term Senior

Notes due December 2037 with a face amount of $23.5 million for a cash payment of $20.0 million.

The transaction resulted in a gain of $2.4 million after the write-off of the discount and deferred

financing costs related to the debt retired.

In October 2008, the Company retired certain Series 2007-1 Class A-2-II-X Fixed Rate Term

Senior Notes due December 2037 with a face amount of $35.2 million for a cash payment of

$20.0 million. The Company recognized a gain on extinguishment of debt of approximately

$12.8 million after the write-off of the discount and deferred financing costs related to the debt retired.

The loss on extinguishment of debt of $2.2 million in 2007 resulted from early debt retirement with

funds generated by the securitization transactions for IHOP. These costs include the write-off of

deferred financing costs in the amount of $1.0 million, and $1.2 million for prepayment penalties as a

result of paying off IHOP’s pre-existing debt.

Loss on Derivative Financial Instrument

As further described under ‘‘Liquidity and Capital Resources,’’ we entered into a swap

arrangement in July 2007. We terminated the swap arrangement upon the consummation of the

Applebee’s acquisition on November 29, 2007. Settlement of the swap resulted in a loss related to the

decline in fair value of the undesignated portion of the hedge of $62.1 million for 2007. No such

transaction occurred in 2008.

Provision for Income Taxes

We recognized a tax benefit of $33.7 million in 2008 as compared to a tax benefit of $2.2 million

in 2007. The change was primarily due to the decrease in our pretax book income, partially offset by

impairment of non-deductible goodwill.

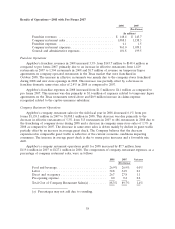

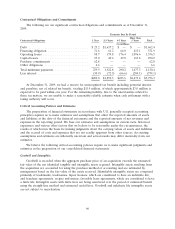

Pro Forma Comparison of the fiscal years ended December 31, 2008 and 2007—Applebee’s

The following section illustrates certain financial results of Applebee’s on a stand-alone basis

comparing 2008 as consolidated into the Company with 2007 information comprised of the 11-month

data from Applebee’s prior to the acquisition date of November 29, 2007 and the one-month data of

Applebee’s subsequent to the acquisition date (‘‘Pro Forma 2007’’).

57