IHOP 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

three-month DSCR was 2.0x and the IHOP three-month DSCR was 3.0x. The DSCR has never fallen

below 1.85x for either the Applebee’s Notes or the IHOP Notes in any period since the Notes were

issued.

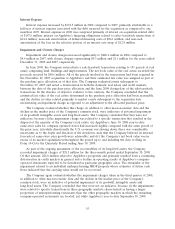

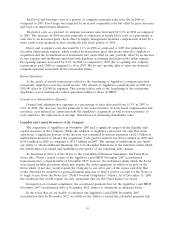

A second covenant test based on DSCR becomes effective under the Applebee’s Notes beginning

with the fiscal quarter commencing January 2010 and ending with the fiscal quarter commencing

October 2012. This test is based on the same DSCR calculation described above but covering the

preceding 12-month period as opposed to the preceding three-month period. A 12-month DSCR below

minimum set forth in the following table can trigger a Partial Amortization Event. In a Partial

Amortization Event, the indenture trustee for the Applebee’s securitization is required to retain an

amount equal to the lesser of (i) the sum of $5,583,000 plus the shortfall, if any, in the retained

amount from a preceding period under a Partial Amortization Event and (ii) the outstanding principal

amount of the Applebee’s Notes plus the shortfall, if any, from a preceding period under a Partial

Amortization Event. All retained amounts are used to retire principal amounts of debt in order of

seniority. The initial minimum 12-month DSCR is 2.20x and that minimum increases by 5 basis points

each quarter, as follows:

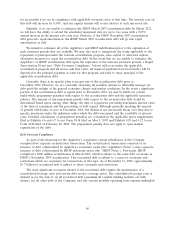

Minimum

Twelve-Month

Fiscal Quarter Commencing in: DCSR

January 2010 ........................................... 2.20x

April 2010 ............................................. 2.25x

July 2010 .............................................. 2.30x

October 2010 ........................................... 2.35x

January 2011 ........................................... 2.40x

April 2011 ............................................. 2.45x

July 2011 .............................................. 2.50x

October 2011 ........................................... 2.55x

January 2012 ........................................... 2.60x

April 2012 ............................................. 2.65x

July 2012 .............................................. 2.70x

October 2012 ........................................... 2.75x

The test of Applebee’s 12-month DSCR set forth above is not required until the payment date

occurring in January 2010 and will end with the payment date occurring in December 2012. The

Applebee’s 12-month DSCR as of December 31, 2009 was 3.07x.

Franchising of Applebee’s Company-Operated Restaurants

Another effect of the Applebee’s acquisition on our liquidity is the planned monetization of certain

Applebee’s assets. We are continuing to pursue a strategy which transitions from our current 80%

franchised Applebee’s system to an approximately 98% franchised Applebee’s system, similar to IHOP’s

99% franchised system. In order to accomplish this strategy, we plan to franchise substantially all of the

company-operated Applebee’s restaurants while retaining part of the Kansas City area as a company

market. This heavily franchised business model is expected to require less capital investment, improve

margins and reduce the volatility of cash flow performance over time, while also providing cash

proceeds from the franchising of the restaurants. If our strategy to transition to a 98% franchised

system is delayed or sales proceeds from franchising restaurants are less than anticipated, we believe

that the company-operated Applebee’s restaurants will continue to generate sufficient cash from

operations to meet our obligations, such that we will not be compelled to enter into refranchising

transactions at prices lower than we deem appropriate. Under the terms of the securitized debt

agreements, all of the proceeds of asset dispositions must be used to retire long-term debt at par.

62