IHOP 2009 Annual Report Download - page 89

Download and view the complete annual report

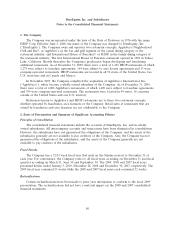

Please find page 89 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We recognize deferred tax assets and liabilities using the enacted tax rates for the effect of

temporary differences between the financial reporting basis and the tax basis of recorded assets and

liabilities. Deferred tax accounting requires that deferred tax assets be reduced by a valuation allowance

if it is more likely than not that some portions or all of the net deferred tax assets will not be realized.

This test requires projection of our taxable income into future years to determine if there will be

taxable income sufficient to realize the tax assets. The preparation of the projections requires

considerable judgment and is subject to change to reflect future events and changes in the tax laws.

When we establish or reduce the valuation allowance against our deferred tax assets, our income tax

expense will increase or decrease, respectively, in the period such determination is made.

Tax contingency reserves result from our estimates of potential liabilities resulting from differences

between actual and audited results. We usually file our income tax returns several months after our

fiscal year end. All tax returns are subject to audit by federal and state governments, usually years after

the returns are filed, and could be subject to differing interpretation of the tax laws. Changes in the tax

contingency reserves result from resolution of audits of prior year filings, the expiration of the statute

of limitations, changes in tax laws and current year estimates for asserted and unasserted items.

Inherent uncertainties exist in estimates of tax contingencies due to changes in tax law, both legislated

and concluded through the various jurisdictions’ tax court systems. Significant changes in our estimates

could materially affect our reported results.

Under U.S. GAAP addressing the accounting for uncertainty in income taxes, tax positions that

previously failed to meet the more-likely-than-not threshold should be recognized in the first

subsequent financial reporting period in which that threshold is met. Previously recognized tax positions

that no longer meet the more-likely-than-not threshold should be derecognized in the first subsequent

financial reporting period in which that threshold is not longer met. We are subject to taxation in many

jurisdictions, and the calculation of our tax liabilities involves dealing with uncertainties in the

application of complex tax laws and regulations in various tax jurisdictions. The application is subject to

legal and factual interpretation, judgment and uncertainty. Tax laws and regulations themselves are

subject to change as a result of changes in fiscal policy, changes in legislation, the evolution of

regulations and court rulings. Therefore, the actual liability for taxes may be materially different from

our estimates, which could result in the need to record additional tax liabilities or to reverse previously

recorded tax liabilities.

Insurance Reserves

We use estimates in the determination of the appropriate liabilities for general liability, workers’

compensation and health insurance. The estimated liability is established based upon historical claims

data and third-party actuarial estimates of settlement costs for incurred claims. Unanticipated changes

in these factors may require us to revise our estimates. We periodically reassess our assumptions and

judgments and make adjustments when significant facts and circumstances dictate. A change in any of

the above estimates could impact our consolidated statements of earnings, and the related asset or

liability recorded in our consolidated balance sheets would be adjusted accordingly. Historically, actual

results have not been materially different than the estimates that are described above.

Derivative Financial Instruments

In the normal course of business we utilize derivative instruments to manage our exposure to

interest rate risks. We account for our derivative instruments under U.S. GAAP that requires that all

derivative instruments be recorded on the balance sheet at fair value and establishes criteria for

designation and effectiveness of the hedging relationships.

We use derivative financial instruments primarily for purposes of hedging exposures to fluctuations

in interest rates. All derivatives are recognized on the balance sheet at fair value. For derivative

70