IHOP 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

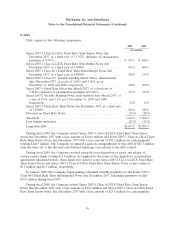

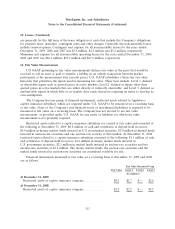

8. Debt (Continued)

Banker’s Association Interest Settlement Rates for deposits in dollars for the applicable period. It is

expected that amounts will be drawn under the Series 2007-2 VFN from time to time as needed by the

IHOP Co-Issuers in connection with the operation of the IHOP franchising business. As of

December 31, 2009 and 2008, a total of $25.0 million and $15.0 million, respectively, was drawn on the

Series 2007-2 VFN. There is a commitment fee on the unused portion of the Series 2007-2 VFN of

0.15% per annum.

March 2007 Securitization Structure

The IHOP Co-Issuers are indirect wholly-owned subsidiaries of the Company that hold

substantially all of the franchising assets used in the operation of the IHOP restaurant franchising

business. In connection with the securitization transaction, two other limited liability companies, IHOP

Property Leasing, LLC and IHOP Real Estate, LLC, were formed as subsidiaries of IHOP

Franchising, LLC and an existing subsidiary, IHOP Properties, Inc., was transferred to IHOP

Franchising, LLC and converted to a limited liability company. On and after the closing of the

securitization transaction, these three subsidiaries (the ‘‘Real Estate Subsidiaries’’) own the real

property assets related to the IHOP restaurant franchising business, including the fee and leasehold

interests on the real property on which many IHOP restaurants are located and the related leases and

sub-leases, respectively, to franchisees.

In connection with the March 2007 Securitization Transaction, the franchise agreements, franchise

notes, area license agreements (related to the United States and Mexico), product sales agreements,

equipment leases and other assets related to the IHOP restaurant franchising business were transferred

to IHOP Franchising, LLC, the intellectual property related to the IHOP restaurant franchising

business, among other things, was transferred to IHOP IP, LLC, the fee interests in real property and

related franchisee leases were transferred to IHOP Real Estate, LLC and certain of the leasehold

interests related to the IHOP franchised restaurants and the related subleases to franchisees were

transferred to IHOP Property Leasing, LLC. The remaining leasehold interests and franchisee

subleases are owned by IHOP Properties, LLC. The IHOP Co-Issuers have pledged all of their assets

to the Indenture Trustee as security for the March 2007 Notes and any additional notes issued by the

IHOP Co-Issuers. Although the March 2007 Notes are expected to be repaid solely from these

subsidiaries’ assets, the March 2007 Notes are solely obligations of the IHOP Co-Issuers and none of

the Company, its direct or indirect subsidiaries, including the Real Estate Subsidiaries, guarantee or are

in any way liable for the IHOP Co-Issuers’ obligations under the Indenture, the March 2007 Notes or

any other obligation in connection with the issuance of the March 2007 Notes. The Company has

agreed, however, to guarantee the performance of the obligations of International House of

Pancakes, LLC., its wholly-owned direct subsidiary, as servicer in connection with the servicing of the

assets included as collateral under the Indenture and certain indemnity obligations relating to the

transfer of the collateral assets to the IHOP Co-Issuers and the Real Estate Subsidiaries.

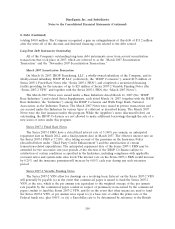

March 2007 Third Party Credit Enhancement

Timely payment of interest (other than contingent interest) and the outstanding principal of the

March 2007 Notes were insured under a financial guaranty insurance policy issued by Financial

Guaranty Insurance Company (‘‘FGIC’’) under an Insurance and Indemnity Agreement among FGIC,

the Company and various subsidiaries of the Company. There are concerns about the solvency of FGIC

and the effectiveness of the insurance policy as FGIC is presently required to suspend payment on all

101