IHOP 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

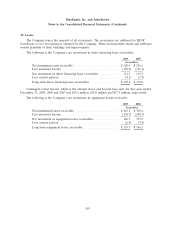

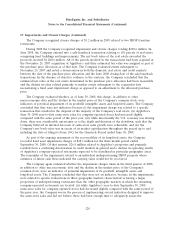

16. Other Comprehensive Income (Loss)

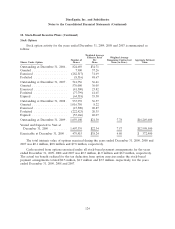

The components of comprehensive income (loss), net of taxes, are as follows:

Year Ended December 31,

2009 2008 2007

(in millions)

Net income (loss) .............................. $31.4 $(154.4) $ (0.5)

Other comprehensive income (net of tax):

Interest rate swap ............................ 8.5 7.7 (36.6)

Temporary decline in available-for-sale securities ...... 0.1 (0.4) —

Total comprehensive income (loss) .................. $40.0 $(147.1) $(37.1)

The amount of income tax benefit allocated to the interest rate swap was $5.6 million, $4.9 million

and $24.1 million for the years ended December 31, 2009, 2008 and 2007, respectively. The amount of

income tax benefit allocated to the temporary decline in available-for-sale securities was $0.1 million

for the year ended December 31, 2008.

The loss related to an interest rate swap designated as a cash flow hedge is being reclassified into

earnings as interest expense over the expected life of the related debt, estimated to be approximately

five years. Approximately $9.2 million, net of tax, is expected to be reclassified into earnings over the

next 12 months.

The accumulated comprehensive loss of $20.8 million (net of tax) as of December 31, 2009 is

comprised of $20.5 million related to a terminated interest rate swap and $0.3 million related to a

temporary decline in available-for-sale securities. The accumulated comprehensive loss of $29.4 million

(net of tax) as of December 31, 2008 is comprised of $29.0 million related to a terminated interest rate

swap and $0.4 million related to a temporary decline in available-for-sale securities.

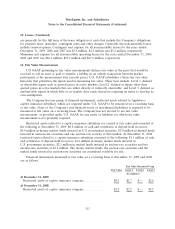

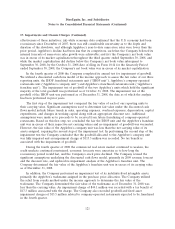

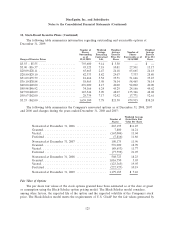

17. Impairments and Closure Charges

Impairment and closure charges for the years ended December 31, 2009, 2008 and 2007 were as

follows:

Year Ended December 31,

2009 2008 2007

(In millions)

Goodwill impairment ........................... $ — $124.8 $ —

Tradename impairment .......................... 93.5 44.1 —

Long-lived tangible asset impairment ................ 10.4 71.4 3.3

Closure charges ............................... 1.2 0.3 1.1

Total impairment and closure charges ................. $105.1 $240.6 $4.4

In accordance with U.S. GAAP, indefinite-lived intangible assets must be evaluated for impairment,

at a minimum, on an annual basis, and more frequently if the Company believes indicators of

impairment exist. Such indicators include, but are not limited to, events or circumstances such as a

significant adverse change in the business climate, unanticipated competition, a loss of key personnel,

adverse legal or regulatory developments, or a significant decline in the market price of the Company’s

118