IHOP 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

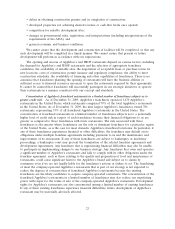

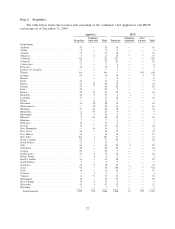

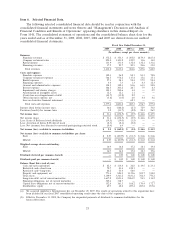

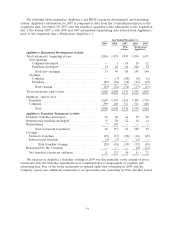

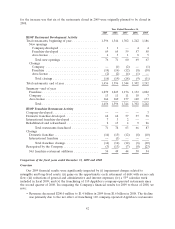

Item 6. Selected Financial Data.

The following selected consolidated financial data should be read in conjunction with the

consolidated financial statements and notes thereto and ‘‘Management’s Discussion and Analysis of

Financial Condition and Results of Operations’’ appearing elsewhere in this Annual Report on

Form 10-K. The consolidated statement of operations and the consolidated balance sheet data for the

years ended and as of December 31, 2009, 2008, 2007, 2006 and 2005 are derived from our audited

consolidated financial statements.

Fiscal Year Ended December 31,

2009 2008 2007(a) 2006 2005

(In millions, except per share amounts)

Revenues

Franchise revenues ................................... $ 372.2 $ 353.3 $ 205.8 $179.3 $167.4

Company restaurant sales ............................... 890.0 1,103.2 125.9 13.6 14.0

Rental income ...................................... 133.9 131.4 132.4 132.1 131.6

Financing revenues ................................... 17.9 25.7 20.5 24.6 35.0

Total revenues .................................... 1,414.0 1,613.6 484.6 349.6 348.0

Costs and expenses

Franchise expenses ................................... 102.3 96.2 88.1 83.1 78.8

Company restaurant expenses ............................ 766.5 978.2 117.4 15.6 15.1

Rental expenses ..................................... 97.3 98.1 98.4 97.9 98.4

Financing expenses ................................... 0.4 7.3 1.3 4.3 12.3

General and administrative expenses ........................ 158.5 182.3 81.6 63.5 58.8

Interest expense ..................................... 186.5 203.2 28.7 7.9 8.3

Impairment and closure charges ........................... 105.1 240.6 4.4 — 0.9

Amortization of intangible assets .......................... 12.3 12.1 1.1 — —

(Gain) loss on extinguishment of debt ....................... (45.7) (15.2) 2.2 — —

Other (income) expense, net ............................. (5.8) (1.0) 2.0 4.4 4.6

Loss on derivative financial instrument ...................... — — 62.1 — —

Total costs and expenses .............................. 1,377.4 1,801.8 487.3 276.7 277.2

Income (loss) before income taxes ........................... 36.6 (188.2) (2.7) 72.9 70.8

Provision (benefit) for income taxes .......................... 5.2 (33.7) (2.2) 28.3 26.9

Net income (loss) ..................................... $ 31.4 $ (154.5) $ (0.5) $ 44.6 $ 43.9

Net income (loss) ..................................... $ 31.4 $ (154.5) $ (0.5) $ 44.6 $ 43.9

Less: Series A Preferred stock dividends ....................... (19.5) (19.0) (1.5) — —

Less: Accretion of Series B Preferred stock ..................... (2.3) (2.1) (0.2) — —

Less: Net (income) loss allocated to unvested participating restricted stock . (0.4) 6.4 — — —

Net income (loss) available to common stockholders ............... $ 9.2 $ (169.2) $ (2.2) $ 44.6 $ 43.9

Net income (loss) available to common stockholders per share:

Basic ............................................ $ 0.55 $ (10.09) $ (0.13) $ 2.46 $ 2.26

Diluted .......................................... $ 0.55 $ (10.09) $ (0.13) $ 2.43 $ 2.24

Weighted average shares outstanding:

Basic ............................................ 16.9 16.8 17.2 18.1 19.4

Diluted .......................................... 16.9 16.8 17.2 18.3 19.6

Dividends declared per common share(b) ...................... — $ 1.00 $ 1.00 $ 1.00 $ 1.00

Dividends paid per common share(b) ......................... — $ 1.00 $ 1.00 $ 1.00 $ 1.00

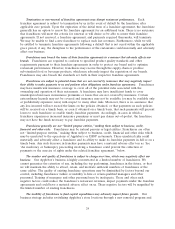

Balance Sheet Data (end of year)

Cash and cash equivalents .............................. $ 82.3 $ 114.4 $ 26.8 $ 19.5 $ 23.1

Restricted cash—short-term ............................. 72.7 83.4 128.1 — —

Restricted cash—long-term .............................. 48.2 53.4 58.0 — —

Property and equipment, net ............................. 771.4 824.5 1,139.6 309.7 318.0

Total assets ........................................ 3,100.9 3,361.2 3,831.2 766.3 770.2

Long-term debt, net of current maturities ..................... 1,637.2 1,853.4 2,263.9 94.5 114.2

Financing obligations, net of current maturities ................. 309.4 318.7 — — —

Capital lease obligations, net of current maturities ............... 152.8 161.3 168.2 170.4 172.7

Stockholders’ equity .................................. 69.9 42.8 209.4 289.2 293.8

(a) We acquired Applebee’s International, Inc. on November 29, 2007. The results of operations related to this acquisition have

been included in our fiscal 2007 consolidated operating results since the date of the acquisition.

(b) Effective December 11, 2008, the Company has suspended payments of dividends to common stockholders for the

foreseeable future.

33