IHOP 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

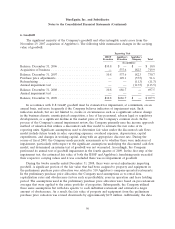

8. Debt (Continued)

Third Party Credit Enhancement

The Series 2007-3 FRN does not have any third party credit enhancement.

Covenants/Restrictions

The covenants under the Indenture and applicable to all notes were modified with the consent of

the holders of the Series 2007-1 FRN.

Prepayment Penalties

In the event a significant portion of the securitization debt is repaid prior to December 2012, the

Company may be liable for certain make-whole prepayment penalties with respect to the securitization

debt and the applicable insurance policies. The amount of any prepayment penalty with respect to the

securitization debt would be determined based upon, among other things, the date of repayment,

prevailing benchmark interest rates at the time of repayment and the percentage of debt repaid.

Weighted Average Effective Interest Rate

The weighted average effective interest rate on all of the notes issued in the November 2007

securitization transactions, exclusive of the amortization of fees and expenses associated with the

securitization transactions, is 7.1799%. Taking into account fees and expenses (excluding the interest

rate swap transaction discussed below) associated with the securitization transactions that will be

amortized as additional non-cash interest expense over a five-year period, which is the expected life of

the notes, the weighted average effective interest rate for the notes issued in November 2007

securitization transactions is 8.4571%.

Covenants/Restrictions Compliance

The Company was in compliance with all the covenants/restriction related to the March 2007 and

November 2007 securitized notes as of December 31, 2009 and has been in compliance for each month

since issuance of the securitized notes.

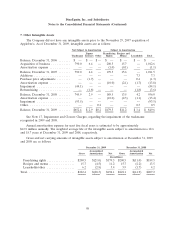

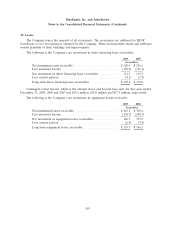

Maturities

At December 31, 2009, the aggregate amounts of existing long-term debt maturing in each of the

next five years and thereafter are as follows:

(In millions)

2010 .................................................. $ 25.2

2011 .................................................. 25.2

2012 .................................................. 1,612.0

2013 .................................................. —

2014 .................................................. —

Thereafter ............................................. —

$1,662.4

106