IHOP 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

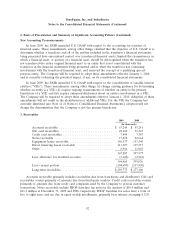

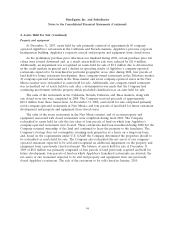

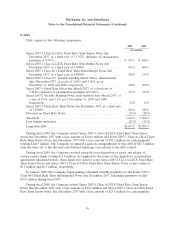

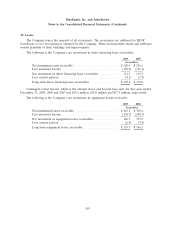

8. Debt

Debt consists of the following components:

2009 2008

(In millions)

Series 2007-1 Class A-2-II-A Fixed Rate Term Senior Notes due

December 2037, at a fixed rate of 7.1767% (inclusive of an insurance

premium of 0.75%) ...................................... $ 599.1 $ 640.6

Series 2007-1 Class A-2-II-X Fixed Rate Term Senior Notes due

December 2037, at a fixed rate of 7.0588% .................... 434.2 604.3

Series 2007-1 Class M-1 Fixed Rate Term Subordinated Notes due

December 2037, at a fixed rate of 8.4044% .................... 104.0 119.0

Series 2007-1 Class A-1 Variable Funding Senior Notes, final maturity

date December 2037, at a rate of 2.89% and 3.86% as of

December 31, 2009 and 2008, respectively ..................... 100.0 100.0

Series 2007-1 Fixed Rate Notes due March 2037, at a fixed rate of

5.744% (inclusive of an insurance premium of 0.60%) ............. 175.0 175.0

Series 2007-2 Variable Funding Notes, final maturity date March 2037, at

a rate of 0.3% and 2.1% as of December 31, 2009 and 2008,

respectively ........................................... 25.0 15.0

Series 2007-3 Fixed Rate Term Notes due December 2037, at a fixed rate

of 7.0588% ............................................ 245.0 245.0

Discount on Fixed Rate Notes ............................... (19.9) (30.5)

Total debt .............................................. 1,662.4 1,868.4

Less current maturities ..................................... (25.2) (15.0)

Long-term debt .......................................... $1,637.2 $1,853.4

During fiscal 2009, the Company retired Series 2007-1 Class A-2-II-X Fixed Rate Term Senior

Notes due December 2037 with a face amount of $164.6 million and Series 2007-1 Class A-2-II-A Fixed

Rate Term Senior Notes due December 2037 with a face amount of $35.2 million for cash payments

totaling $146.9 million. The Company recognized a gain on extinguishment of this debt of $45.7 million

after the write-off of the discount and deferred financing costs related to the debt retired.

During fiscal 2009, the Company received proceeds from disposition of assets and release of

certain reserve funds totaling $11.8 million. As required by the terms of the Applebee’s securitization

agreements (discussed below), these funds were used to retire Series 2007-1 Class A-2-II-X Fixed Rate

Term Senior Notes and Series 2007-1 Class A-2-II-A Fixed Rate Term Senior Notes at face values of

$5.5 million and $6.3 million, respectively.

In January 2009, the Company began making scheduled monthly payments on the Series 2007-1

Class M-1 Fixed Rate Term Subordinated Notes due December 2037. Scheduled payments totaled

$15.0 million during fiscal 2009.

During fiscal 2008, the Company retired Series 2007-1 Class A-2-II-X Fixed Rate Term Senior

Notes due December 2037 with a face amount of $35.2 million and Series 2007-1 Class A-2-II-A Fixed

Rate Term Senior Notes due December 2037 with a face amount of $23.5 million for cash payments

99