IHOP 2009 Annual Report Download - page 69

Download and view the complete annual report

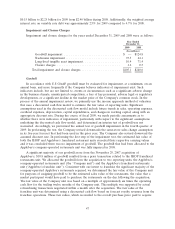

Please find page 69 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2008, the Company entered into a sale-leaseback transaction relating to 181 parcels of real

estate comprising land, buildings and improvements. The net book value of the real estate exceeded the

proceeds received by $40.6 million. All of the parcels involved in the transactions had been acquired in

the November 29, 2007 acquisition of Applebee’s and their estimated fair value was assigned as part of

the purchase price allocation as of that date. The Company evaluated events subsequent to

November 29, 2007 and noted a deterioration in both the domestic real estate and credit markets

between the date of the purchase price allocation and the June 2008 closing date of the sale-leaseback

transactions. In the absence of objective evidence to the contrary, the Company concluded that the

estimated fair value of the real estate determined in the purchase price allocation had been reasonable,

and the decline in value related primarily to market events subsequent to the acquisition date

necessitating an impairment charge as opposed to an adjustment to the allocated purchase price.

The Company evaluated whether this charge, in addition to other macroeconomic data and the

decline in the market price of the Company’s common stock, were indicators of potential impairment

of its goodwill, intangible assets and long-lived assets. The Company concluded that they were not

indicators, because (i) the impairment charge was related to a specific transaction that resulted in the

disposal of the majority of the Company’s real estate; (ii) Applebee’s June 30, 2008 year-to-date

same-store sales for company-operated stores had increased slightly compared with the same period of

the prior year; (iii) while directionally the U.S. economy was slowing down, there was considerable

uncertainty as to the depth and duration of the slowdown, such that the Company believed its internal

forecasts of same-store sales growth were achievable; and (iv) the Company’s net book value was in

excess of its market capitalization throughout the period up to and including the date of filing its

Form 10-Q for the Quarterly Period ending June 30, 2008.

As part of the ongoing assessment of the recoverability of its long-lived assets, the Company

recorded impairment charges of $28.3 million for the three-month period ended September 30, 2008.

Of that amount, $26.8 million related to Applebee’s properties and primarily resulted from a continuing

deterioration in credit markets in general and a decline in operating results of Applebee’s company-

operated restaurants expected to be franchised in particular geographic areas. The remainder of the

impairment related to an individual underperforming IHOP property whose estimates of future cash

flows indicated that the carrying value would not be recovered.

The Company again evaluated whether the impairment charges taken in the third quarter of 2008,

in addition to other macroeconomic data and the decline in the market price of the Company’s

common stock, were an indicator of potential impairment of its goodwill, intangible assets and

long-lived assets. The Company concluded that they were not an indicator, because (i) the impairments

were related to specific transactions in three geographic markets characterized as having a larger

proportion of underperforming restaurants than the other geographic markets in which the remaining

company-operated restaurants are located; (ii) while Applebee’s year-to-date September 30, 2008

same-store sales for company-operated stores had decreased slightly compared with the same period of

the prior year, the Company was in the process of implementing several initiatives designed to improve

the same-store sales and did not believe there had been enough time to adequately assess the

effectiveness of those initiatives; (iii) while economic data confirmed that the U.S. economy had been

recessionary since December of 2007, there was still considerable uncertainty as to the depth and

duration of the slowdown, and although Applebee’s year-to-date same-store sales were lower than the

prior period, Applebee’s decline had been less than its competitors, such that the Company believed its

internal forecasts of same-store sales growth were achievable; and (iv) the Company’s net book value

was in excess of its market capitalization throughout the third quarter ended September 30, 2008, and

while the market capitalization did decline below the Company’s net book value subsequent to

September 30, 2008, by the October 31, 2008 date of filing its Form 10-Q for the Quarterly Period

ending September 30, 2008, the Company’s net book value was in excess of its market capitalization.

50