IHOP 2009 Annual Report Download - page 107

Download and view the complete annual report

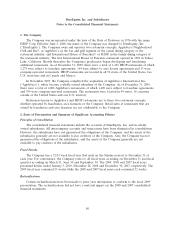

Please find page 107 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

For more information on the financial instruments the Company measures at fair value, see

Note 11, Fair Value Measurements.

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability

method, deferred taxes are determined based on the temporary differences between the financial

statement and tax bases of assets and liabilities using enacted tax rates. A valuation allowance is

recorded when it is more likely than not that some of the deferred tax assets will not be realized. The

Company also determines its tax contingencies in accordance with U.S. GAAP governing the

accounting for contingencies. The Company records estimated tax liabilities to the extent the

contingencies are probable and can be reasonably estimated.

Effective January 1, 2007, the Company adopted U.S. GAAP governing the determination of how

tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial

statements. The Company recognizes the tax benefit from an uncertain tax position only if it is more

likely than not that the tax position will be sustained on examination by the taxing authorities, based on

the technical merits of the position. The tax benefits recognized in the financial statements from such a

position are measured based on the largest benefit that has a greater than fifty percent likelihood of

being realized upon ultimate resolution. The impact of the Company’s reassessment of its tax positions

upon adoption did not have a material impact on the results of operations, financial condition or

liquidity.

Stock-Based Compensation

The Company has in effect stock incentive plans under which incentive stock options have been

granted to employees and restricted stock units and non-qualified stock options have been granted to

employees and non-employee members of the Board of Directors. The Company accounts for all stock-

based payments to employees and non-employees, including grants of employee stock options and

restricted stock units to be recognized in the financial statements, based on their respective grant date

fair values. The Company also accounts for the benefits of tax deduction in excess of recognized

compensation cost be reported as a financing cash flow.

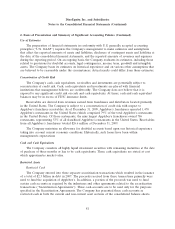

U.S. GAAP requires companies to estimate the fair value of stock-based payment awards on the

date of grant using an option-pricing model. The value of the portion of the award that is ultimately

expected to vest is recognized as expense ratably over the requisite service periods. The Company has

estimated the fair value of each award as of the date of grant or assumption using the Black-Scholes

option pricing model, which considers, among other factors, the expected life of the award and the

expected volatility of the Company’ stock price. Although the Black-Scholes model meets the

requirement of U.S. GAAP and the SEC, the fair values generated by the model may not be indicative

of the actual fair values of the Company’s awards, as it does not consider other factors important to

those stock-based payment awards, such as continued employment, periodic vesting requirements and

limited transferability.

The Company accounts for option grants to non-employees in accordance with U.S. GAAP,

whereby the fair value of such options is determined using the Black-Scholes option pricing model at

the earlier of the date at which the non-employee’s performance is complete or a performance

commitment is reached.

88