IHOP 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

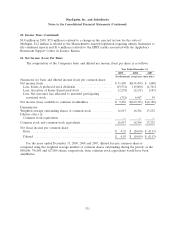

17. Impairments and Closure Charges (Continued)

effectiveness of those initiatives; (iii) while economic data confirmed that the U.S. economy had been

recessionary since December of 2007, there was still considerable uncertainty as to the depth and

duration of the slowdown, and although Applebee’s year-to-date same-store sales were lower than the

prior period, Applebee’s decline had been less that its competitors, such that the Company believed its

internal forecasts of same-store sales growth were achievable; and (iv) the Company’s net book value

was in excess of its market capitalization throughout the third quarter ended September 30, 2008, and

while the market capitalization did decline below the Company’s net book value subsequent to

September 30, 2008, by the October 31, 2008 date of filing its Form 10-Q for the Quarterly Period

ended September 30, 2008, the Company’s net book value was in excess of its market capitalization.

In the fourth quarter of 2008 the Company completed its annual test for impairment of goodwill.

We utilized a discounted cash flows model of the income approach to assess the fair value of our three

reporting units, the IHOP franchised restaurants unit (‘‘IHOP unit’’), Applebee’s company-operated

restaurants unit (‘‘Applebee’s company unit’’) and Applebee’s franchised restaurants unit (‘‘Applebee’s

franchise unit’’). The impairment test of goodwill of the two Applebee’s units which hold the significant

majority of the total goodwill was performed as of October 31, 2008. The impairment test of the

goodwill of the IHOP unit was performed as of December 31, 2008, the date as of which the analysis

has been performed in prior years.

The first step of the impairment test compared the fair value of each of our reporting units to

their carrying value. Significant assumptions used to determine fair value under the discounted cash

flows model include future trends in sales, operating expenses, overhead expenses, depreciation, capital

expenditures, and changes in working capital along with an appropriate discount rate. Additional

assumptions were made as to proceeds to be received from future franchising of company-operated

restaurants. Based on this first step, we concluded the fair the IHOP unit and the Applebee’s franchise

unit was in excess of their respective net carrying values and no impairment of goodwill was warranted.

However, the fair value of the Applebee’s company unit was less than the net carrying value of its

assets assigned, requiring the second step of the impairment test. In performing the second step of the

impairment test the Company concluded that the goodwill allocated to the Applebee’s company unit

was fully impaired and an impairment charge of $113.5 million was recorded. No tax benefit is

associated with the impairment of goodwill.

During the fourth quarter of 2008 the commercial real estate market continued to weaken, the

credit markets continued constrained, economic forecasts were uncertain as to how long the

recessionary period would last, and the Company’s stock price declined. The Company revised the

significant assumptions underlying the discounted cash flows model, primarily its 2009 revenue forecast

and the discount rate, and updated its impairment analysis of the Applebee’s franchise unit. The

Company determined the fair value of the Applebee’s franchise unit was in excess of its carrying value

as of December 31, 2008.

In addition, the Company performed an impairment test of its indefinite-lived intangible assets,

primarily the Applebee’s tradename assigned in the purchase price allocation. The Company utilized

the relief from royalty method under the income approach to determine the fair value of the

tradename. The Company determined the fair value of the tradename as of December 31, 2008 was

less than the carrying value. An impairment charge of $44.1 million was recorded with a tax benefit of

$17.3 million associated with the charge. The Company also recorded goodwill and fixed asset

impairment charges of $13.5 million related to company-operated restaurants expected to be franchised

in the fourth quarter.

121