IHOP 2009 Annual Report Download - page 91

Download and view the complete annual report

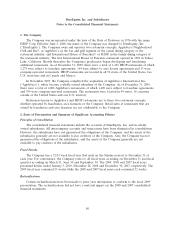

Please find page 91 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.requirements on January 1, 2009, and will apply the provisions prospectively to any intangible assets

acquired after the effective date.

In June 2008, the FASB amended U.S. GAAP with respect to determining if an instrument granted

in a share-based payment transaction is a participating security. These amendments, among other

things, require unvested share-based payment awards that contain rights to receive non-forfeitable

dividends or dividend equivalents to be included in the two-class method of computing earnings per

share. The Company retroactively adopted these amendments on January 1, 2009. The impact of the

adoption on earnings per share as previously reported for the years ended December 31, 2008 and 2007

was not material.

In April 2009, the FASB amended U.S. GAAP to address concerns regarding (a) determining

whether a market is not active and a transaction is not orderly, (b) recognition and presentation of

other-than-temporary impairments and (c) interim disclosures of fair values of financial instruments.

The Company adopted these amendments effective April 1, 2009. There was no impact of the adoption

on the Company’s consolidated financial statements.

In May 2009, the FASB amended U.S. GAAP with respect to subsequent events. These

amendments, among other things, established general standards of accounting for and disclosures of

events that occur after the balance sheet date but before financial statements are issued or are

available to be issued. The Company adopted these amendments effective April 1, 2009. The FASB

modified its guidance in February 2010 and the Company adopted the modification for its December

2009 financial reporting. There was no impact of the adoption or the modification on the Company’s

consolidated financial statements.

In June 2009, the FASB established the FASB Accounting Standards Codification (the

‘‘Codification’’) as the source of authoritative accounting principles recognized by the FASB to be

applied by nongovernmental entities in the preparation of financial statements in conformity with

U.S. GAAP. Rules and interpretive releases of the Securities and Exchange Commission (the ‘‘SEC’’)

under authority of federal securities laws are also sources of authoritative U.S. GAAP for SEC

registrants. All guidance contained in the Codification carries an equal level of authority. The

Codification became effective for the Company in the third fiscal quarter of 2009. Adoption of the

Codification did not have a material effect on the Company’s financial statements.

In August 2009, the FASB amended U.S. GAAP with respect to measuring liabilities at fair value.

These amendments provide clarification that in circumstances in which a quoted price in an active

market for the identical liability is not available, a reporting entity is required to measure fair value of

such liability using one or more of the techniques prescribed by the update. Adoption of these

amendments in the fourth quarter of fiscal year 2009 did not have a material effect on the Company’s

financial statements.

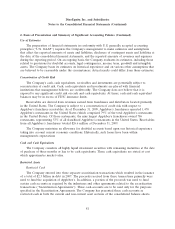

New Accounting Pronouncements

In June 2009, the FASB amended U.S. GAAP with respect to the accounting for transfers of

financial assets. These amendments, among other things, clarified that the objective of U.S. GAAP is to

determine whether a transferor and all of the entities included in the transferor’s financial statements

being presented have surrendered control over transferred financial assets; limited the circumstances in

which a financial asset, or portion of a financial asset, should be derecognized when the transferor has

not transferred the entire original financial asset to an entity that is not consolidated with the

transferor in the financial statements being presented and/or when the transferor has continuing

involvement with the transferred financial asset; and removed the concept of a qualifying special-

purpose entity. The Company will be required to adopt these amendments effective January 1, 2010,

and is currently evaluating the potential impact, if any, on its consolidated financial statements.

72